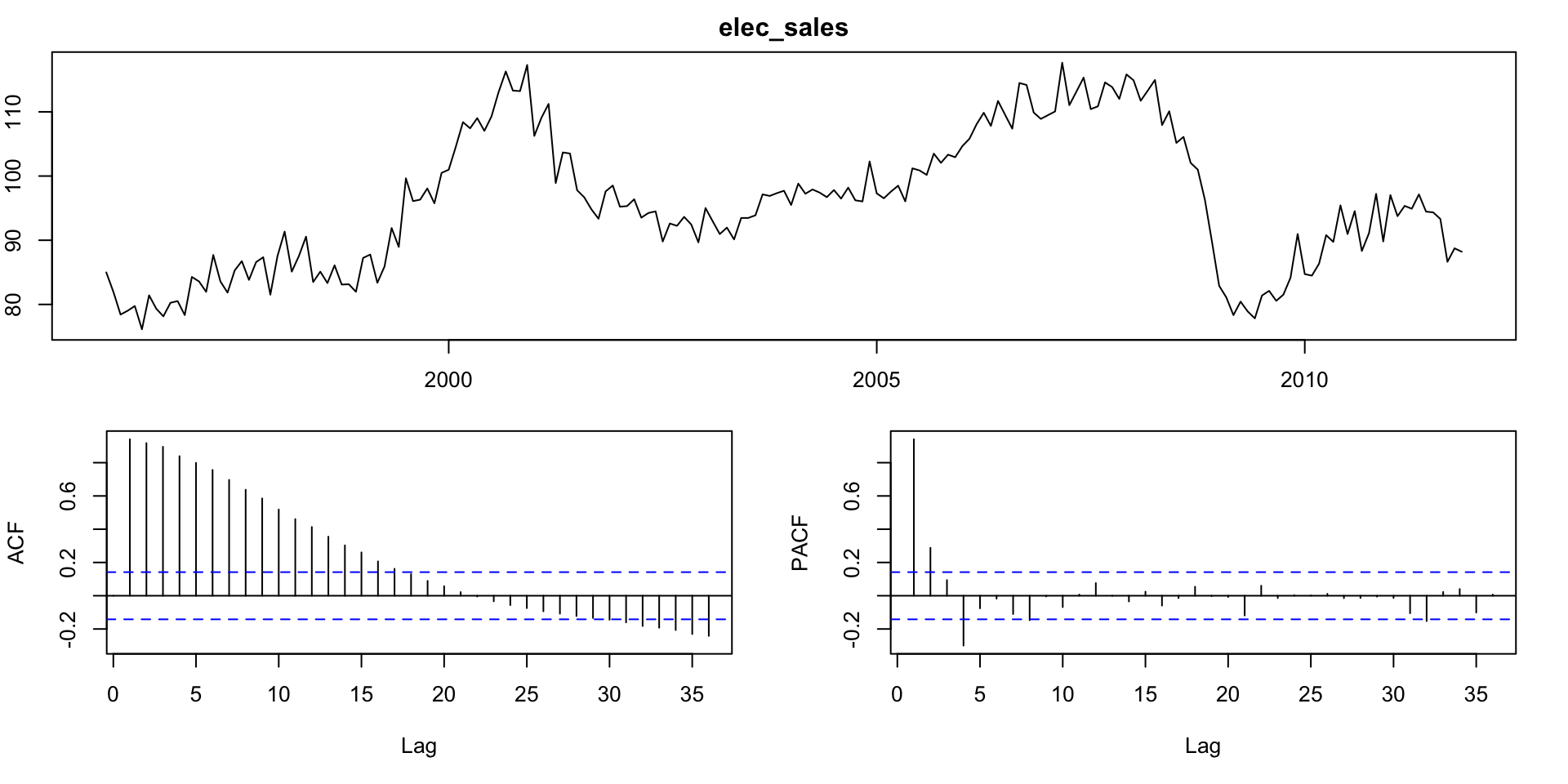

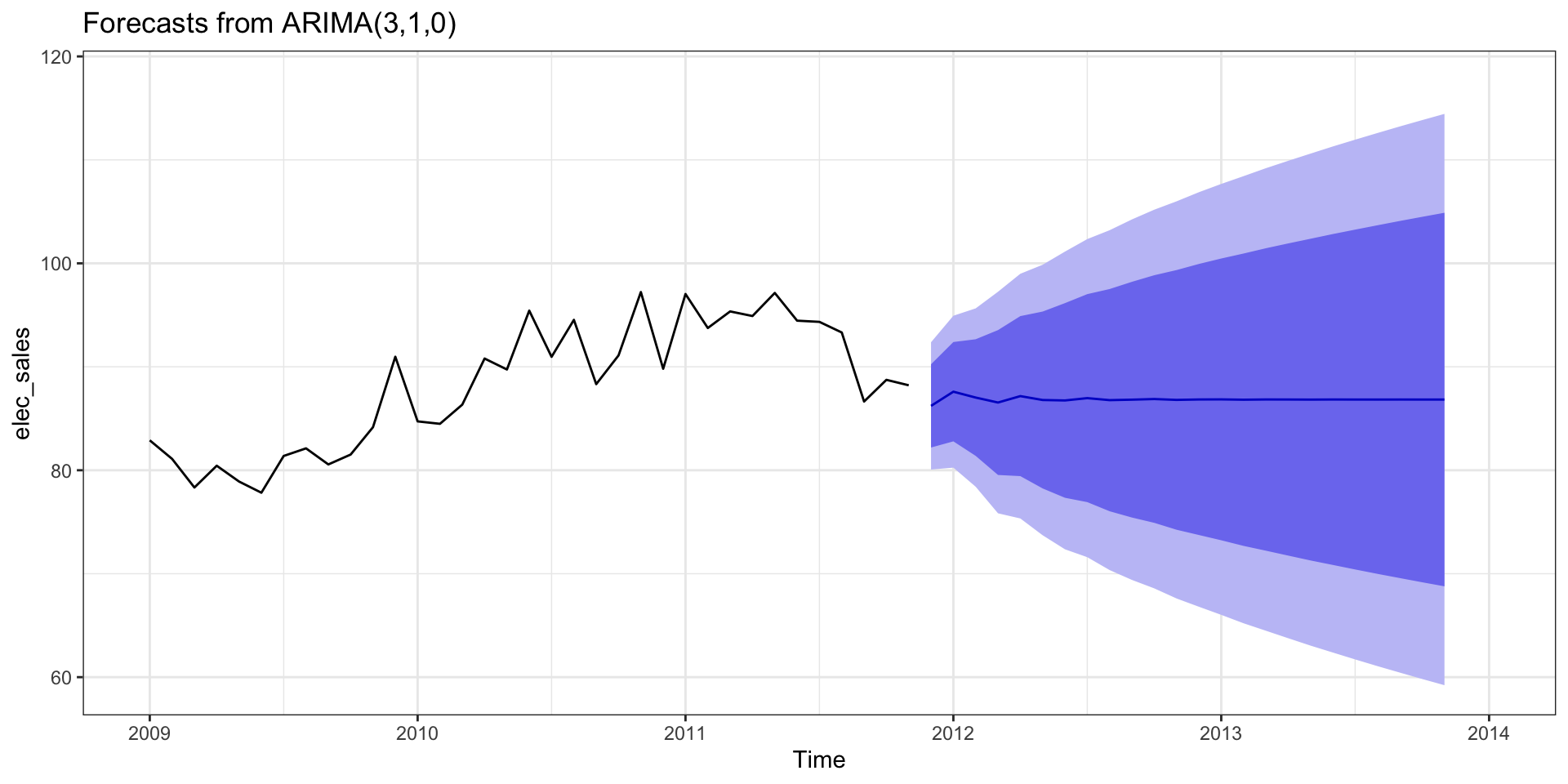

Series: elec_sales

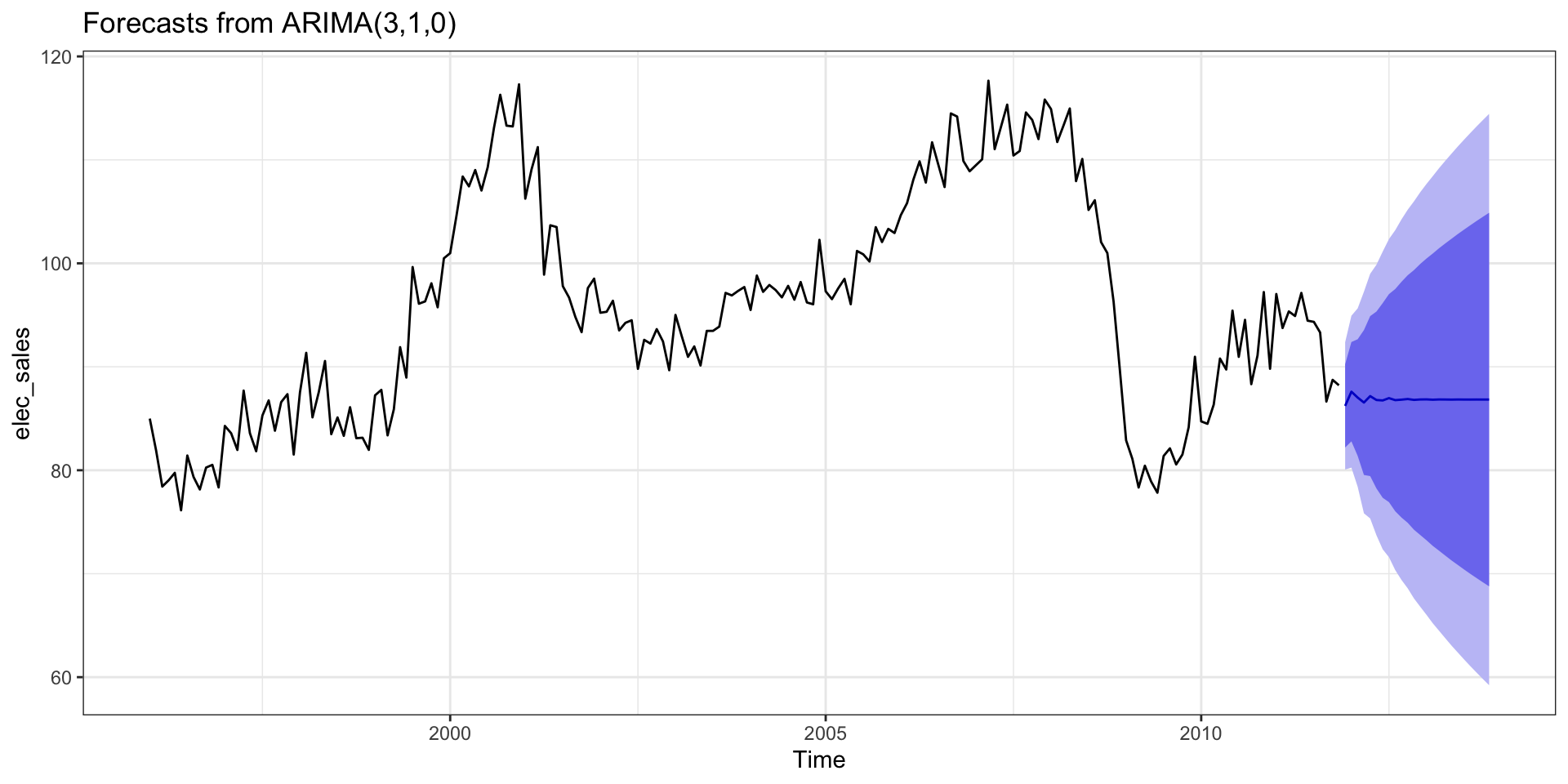

ARIMA(3,1,0)

Coefficients:

ar1 ar2 ar3

-0.3488 -0.0386 0.3139

s.e. 0.0690 0.0736 0.0694

sigma^2 = 9.853: log likelihood = -485.67

AIC=979.33 AICc=979.55 BIC=992.32Seasonal Arima

Lecture 11

ARIMA - General Guidance

Positive autocorrelations out to a large number of lags usually indicates a need for differencing

Slightly too much or slightly too little differencing can be corrected by adding AR or MA terms respectively.

A model with no differencing usually includes a constant term, a model with two or more orders (rare) differencing usually does not include a constant term.

After differencing, if the PACF has a sharp cutoff then consider adding AR terms to the model.

After differencing, if the ACF has a sharp cutoff then consider adding an MA term to the model.

It is possible for an AR term and an MA term to cancel each other’s effects, so try models with fewer AR terms and fewer MA terms.

Electrical Equipment Sales

Data

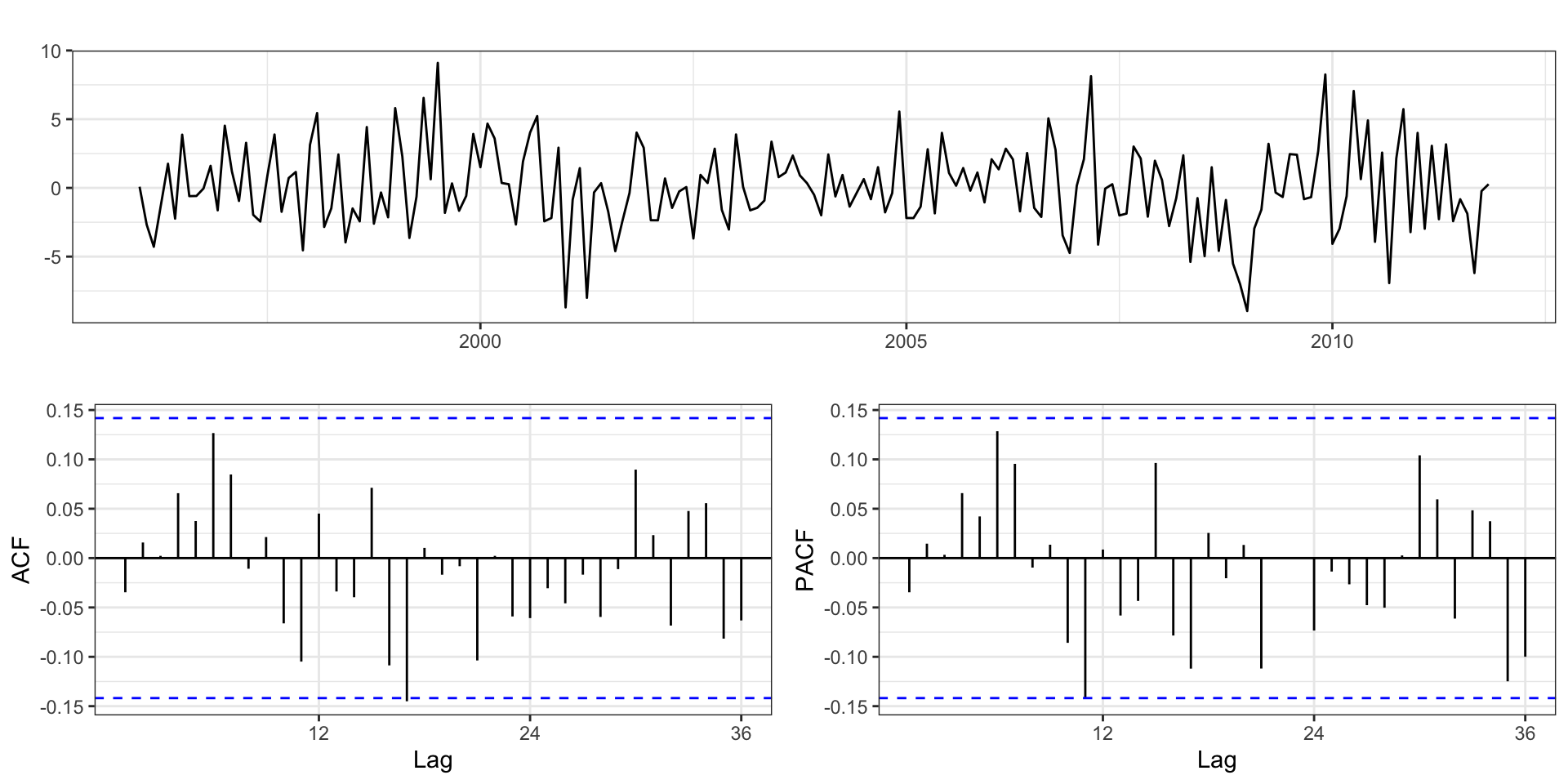

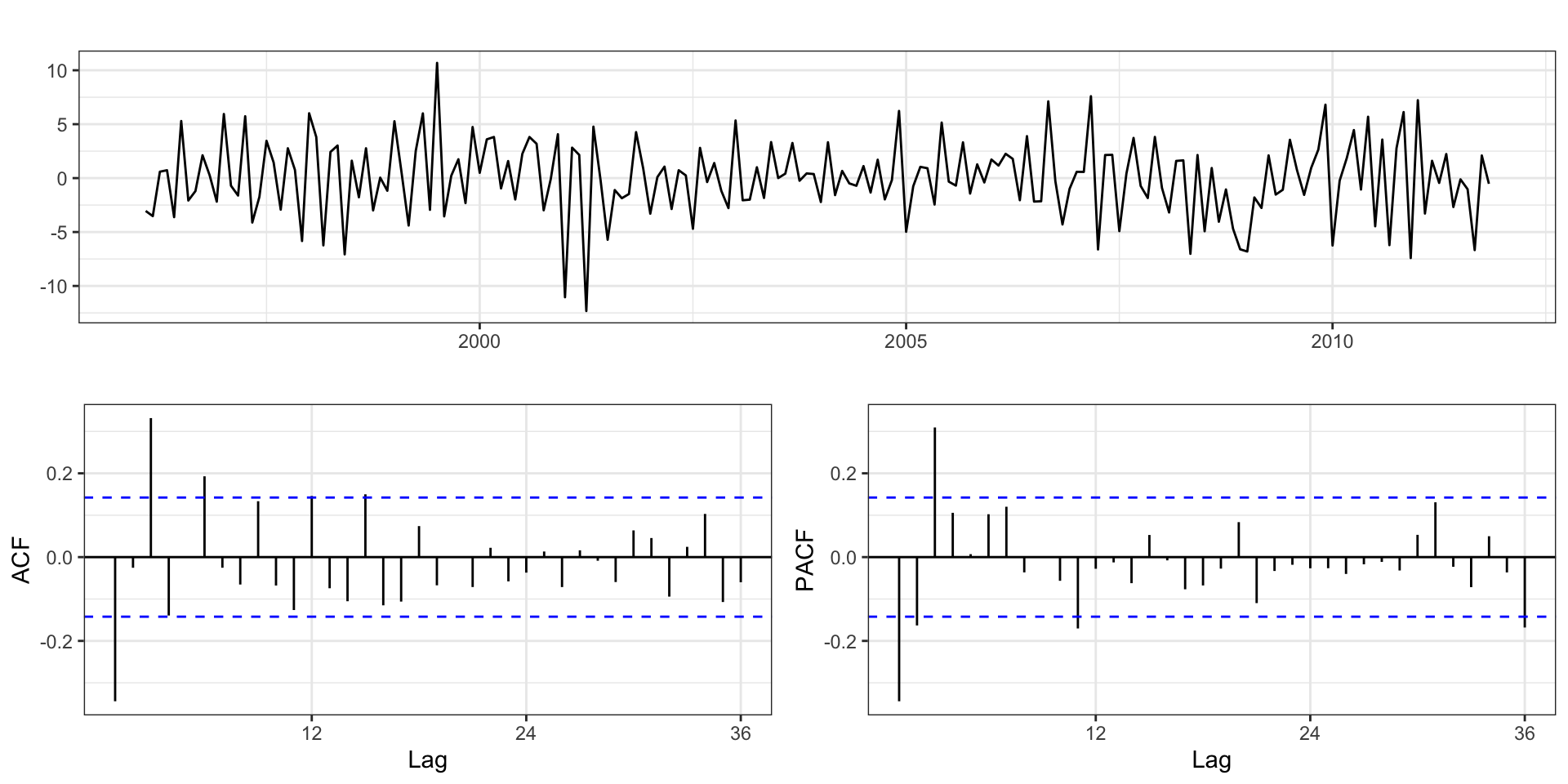

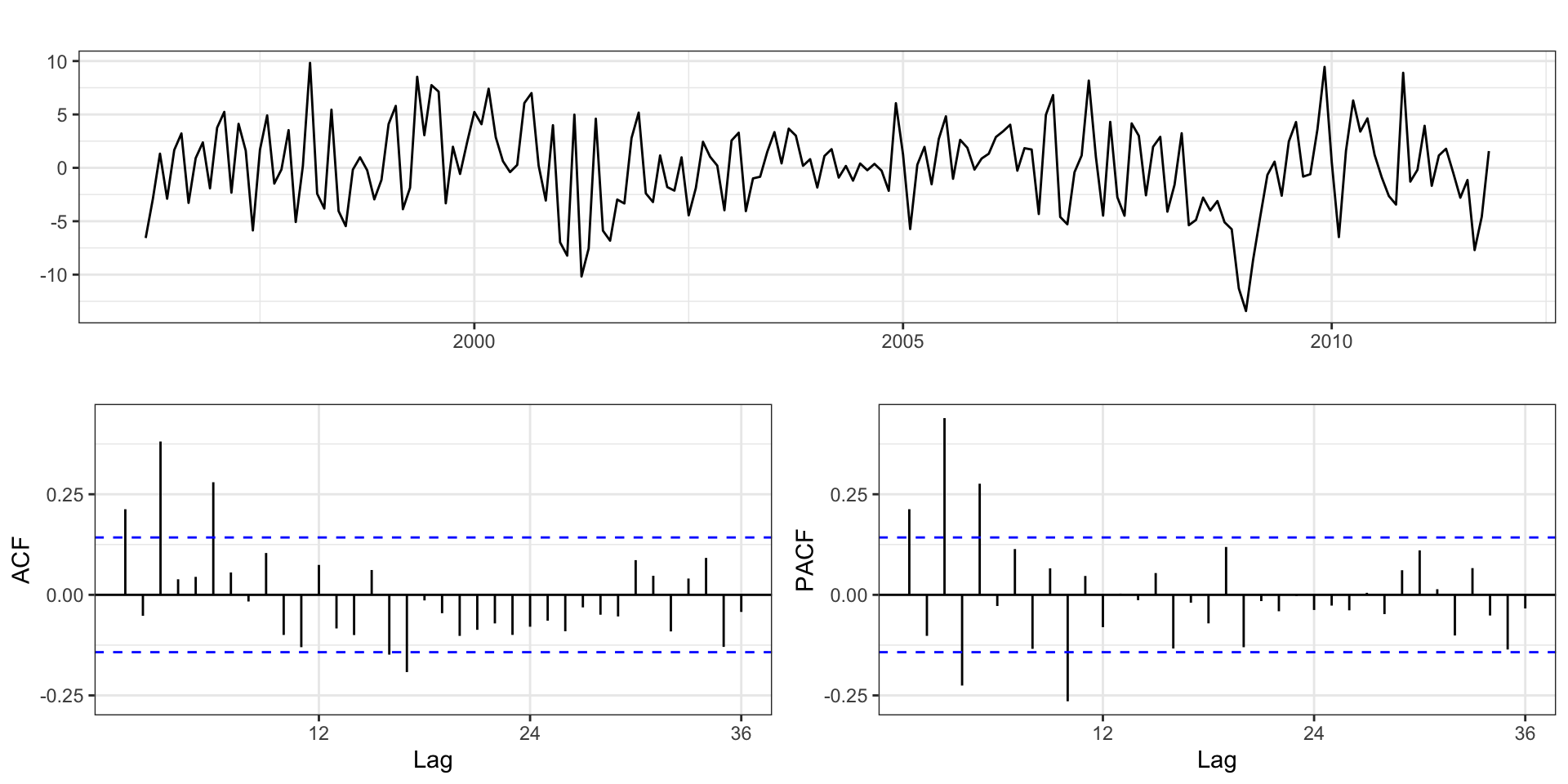

1st order differencing

2nd order differencing

Model

Residuals

Model Comparison

Model choices:

Automatic selection (AICc)

Automatic selection (BIC)

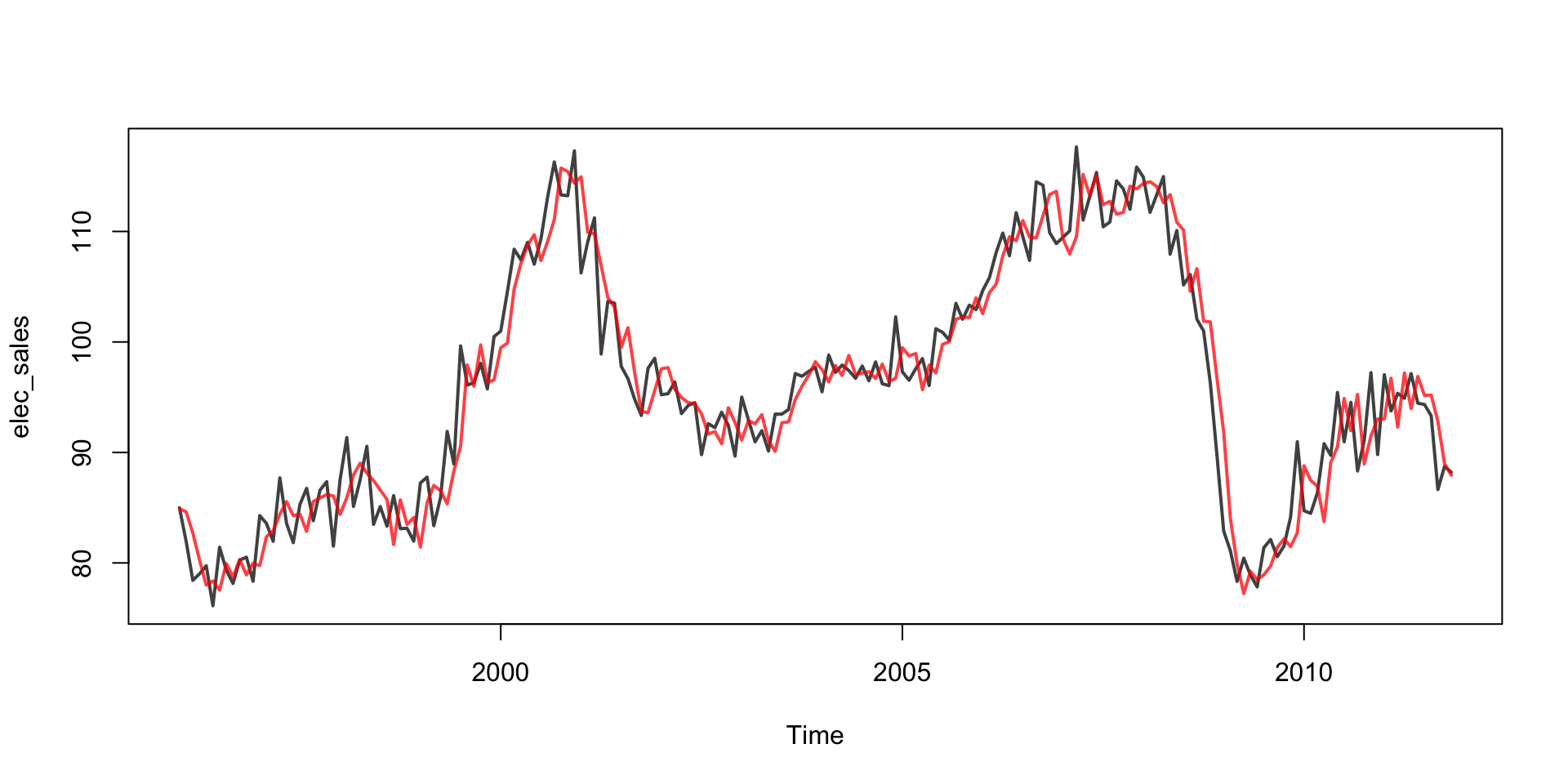

Model fit

Model forecast

Model forecast - Zoom

Seasonal Models

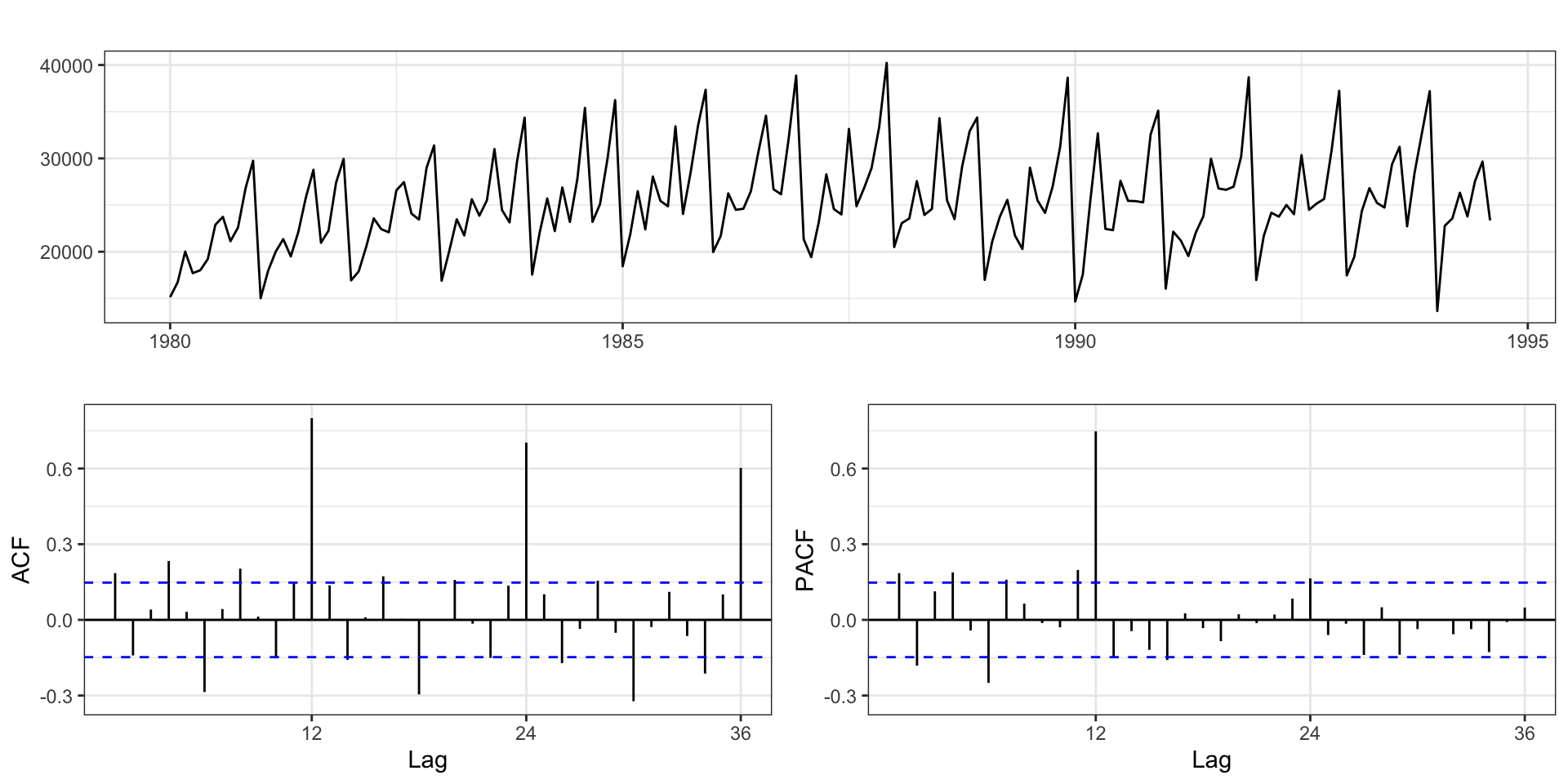

Australian Wine Sales Example

Australian total wine sales by wine makers in bottles <= 1 litre. Jan 1980 – Aug 1994.

Differencing

Seasonal Arima

We can extend the existing ARIMA model to handle these higher order lags (without having to include all of the intervening lags).

Seasonal \(\text{ARIMA}\,(p,d,q) \times (P,D,Q)_s\): \[ \Phi_P(L^s) \, \phi_p(L) \, \Delta_s^D \, \Delta^d \, y_t = \delta + \Theta_Q(L^s) \, \theta_q(L) \, w_t\] . . .

where

\[ \begin{aligned} \phi_p(L) &= 1-\phi_1 L - \phi_2 L^2 - \ldots - \phi_p L^p\\ \theta_q(L) &= 1+\theta_1 L + \theta_2 L^2 + \ldots + \theta_p L^q \\ \Delta^d &= (1-L)^d\\ \\ \Phi_P(L^s) &= 1-\Phi_1 L^s - \Phi_2 L^{2s} - \ldots - \Phi_P L^{Ps} \\ \Theta_Q(L^s) &= 1+\Theta_1 L + \Theta_2 L^{2s} + \ldots + \theta_p L^{Qs} \\ \Delta_s^D &= (1-L^s)^D\\ \end{aligned} \]

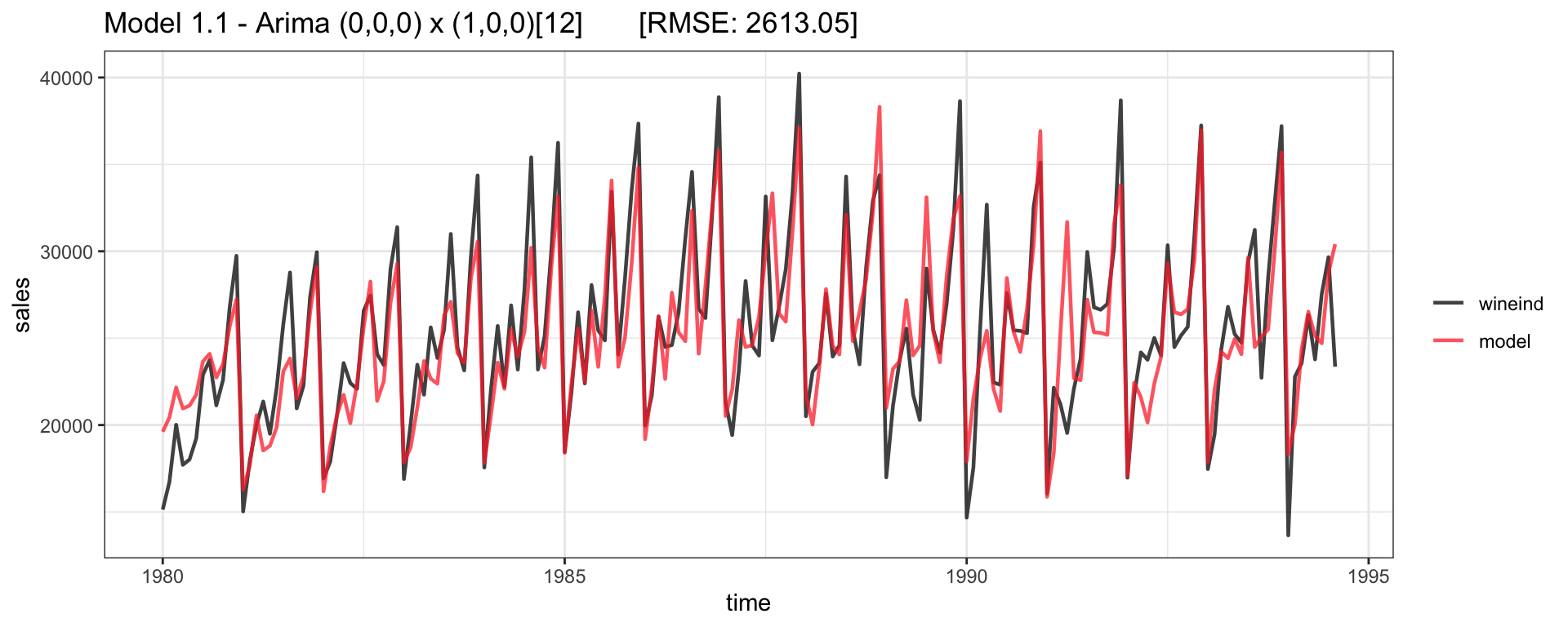

Seasonal ARIMA - AR

Lets consider an \(\text{ARIMA}(0,0,0) \times (1,0,0)_{12}\): \[ \begin{aligned} (1-\Phi_1 L^{12}) \, y_t = \delta + w_t \\ y_t = \Phi_1 y_{t-12} + \delta + w_t \end{aligned} \]

Fitted - Model 1.1

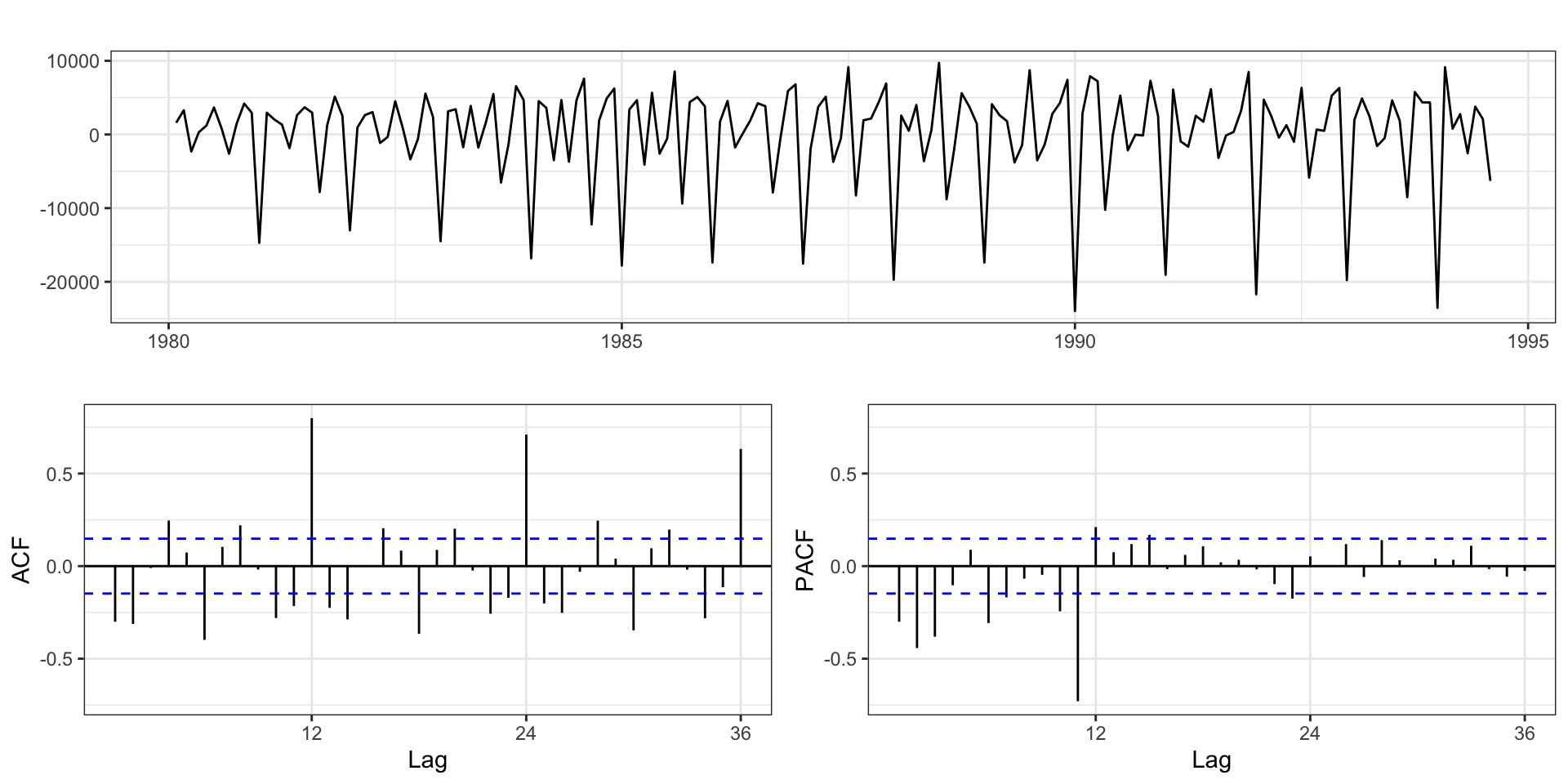

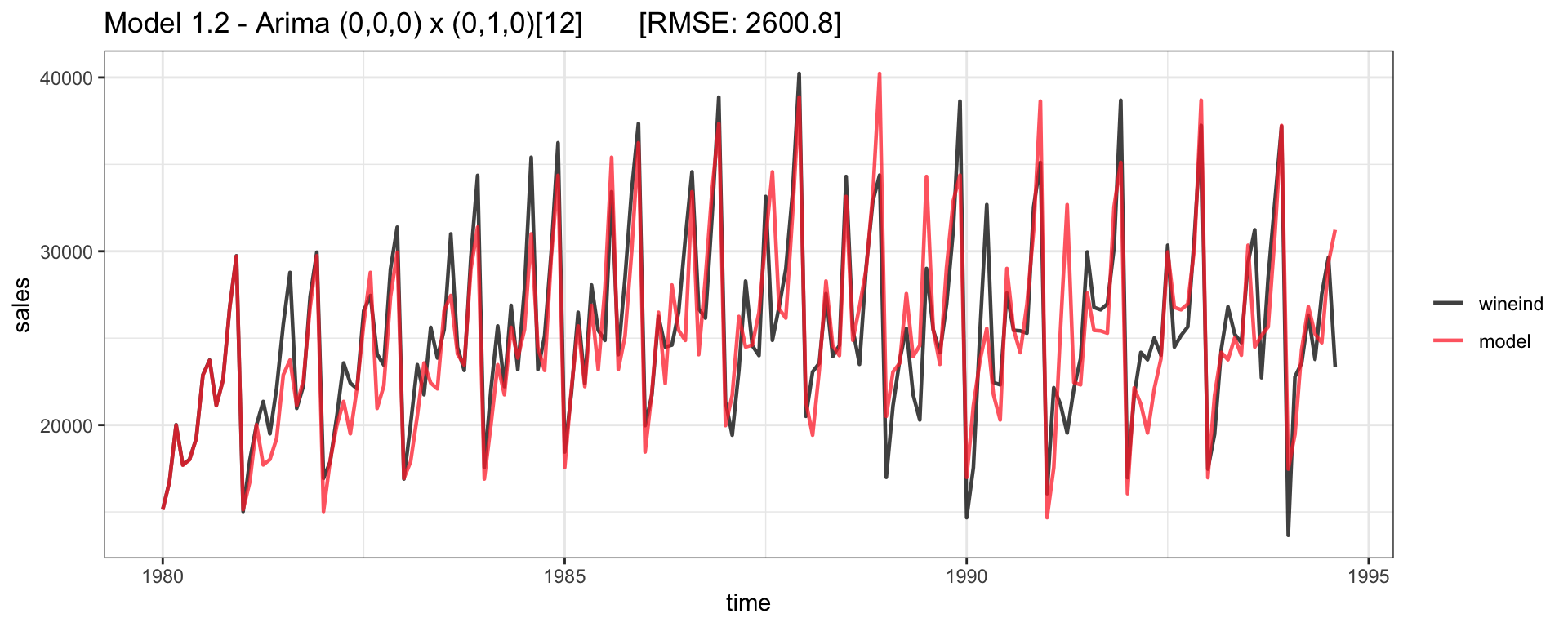

Seasonal Arima - Diff

Lets consider an \(\text{ARIMA}(0,0,0) \times (0,1,0)_{12}\): \[ \begin{aligned} (1 - L^{12}) \, y_t = \delta + w_t \\ y_t = y_{t-12} + \delta + w_t \end{aligned} \]

Fitted - Model 1.2

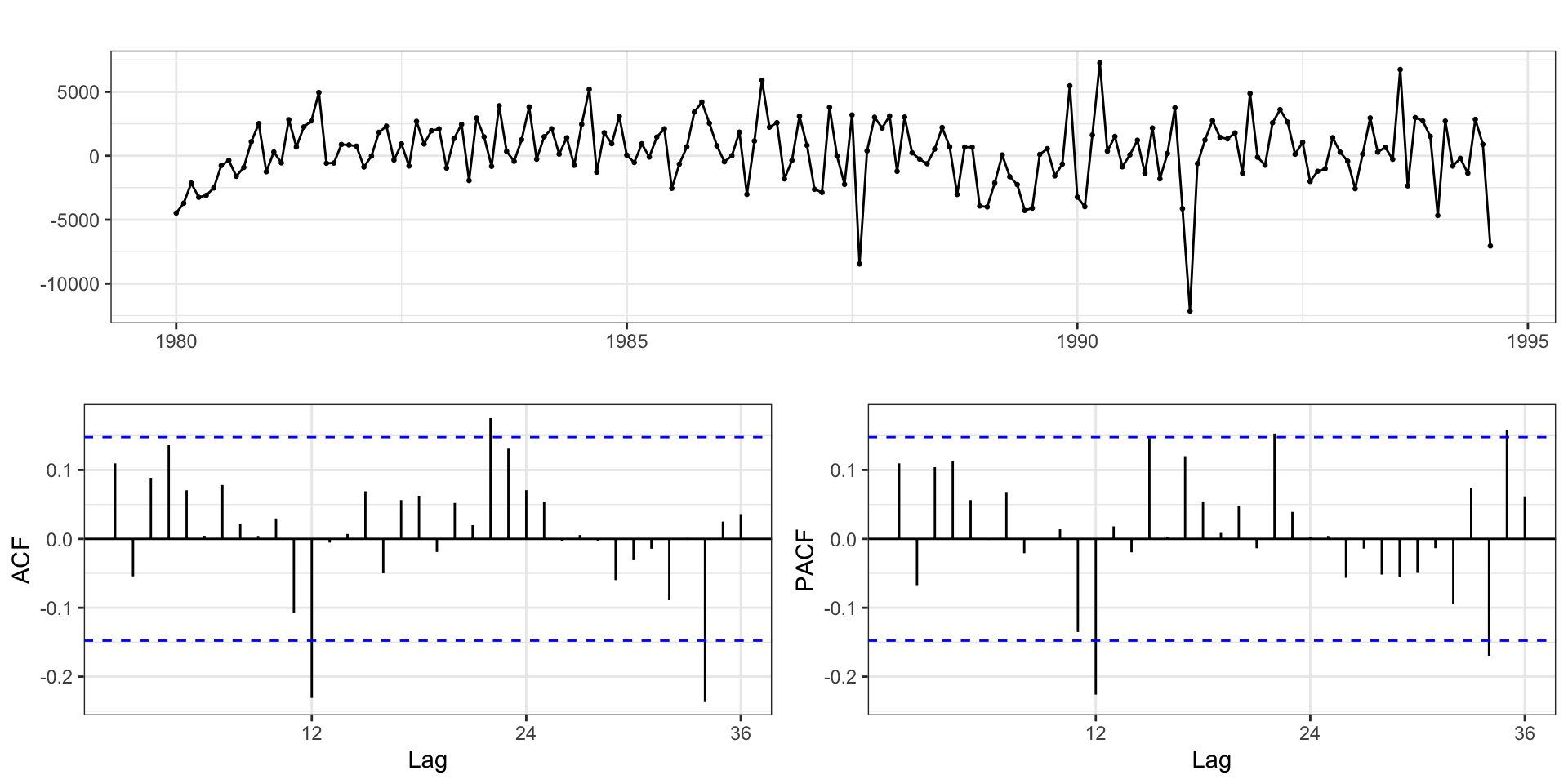

Residuals - Model 1.1 (SAR)

Residuals - Model 1.2 (SDiff)

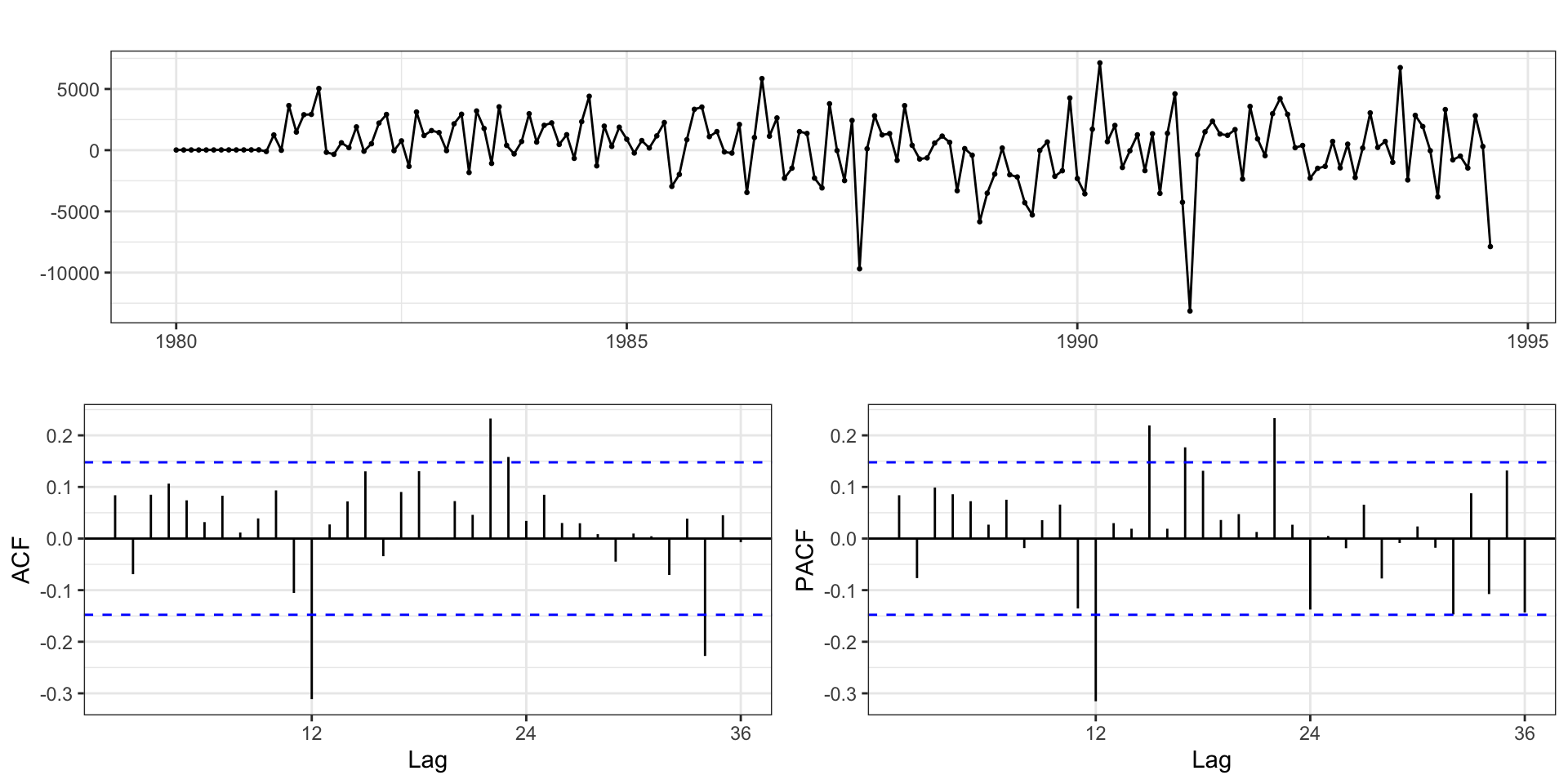

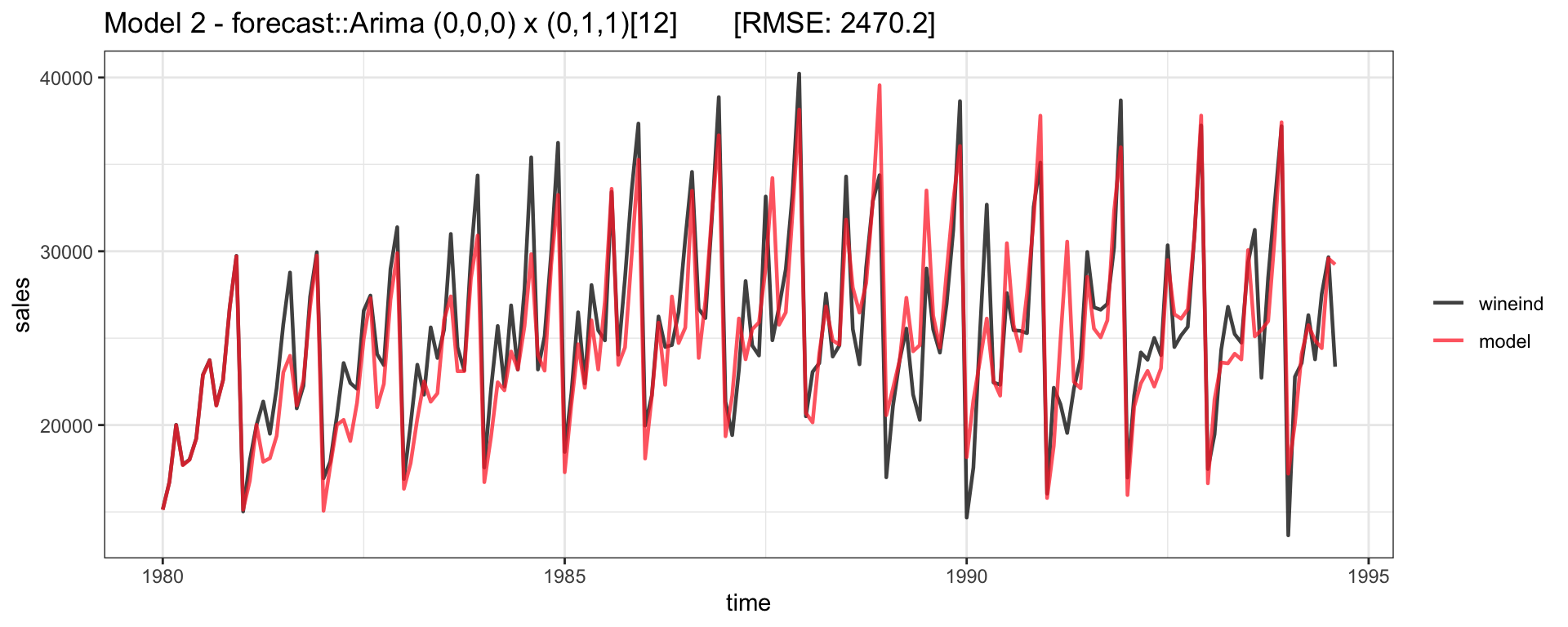

Model 2

\(\text{ARIMA}(0,0,0) \times (0,1,1)_{12}\):

\[ \begin{aligned} (1-L^{12}) y_t = \delta + (1+\Theta_1 L^{12}) w_t \\ y_t = \delta + y_{t-12} + w_t + \Theta_1 w_{t-12} \end{aligned} \]

Fitted - Model 2

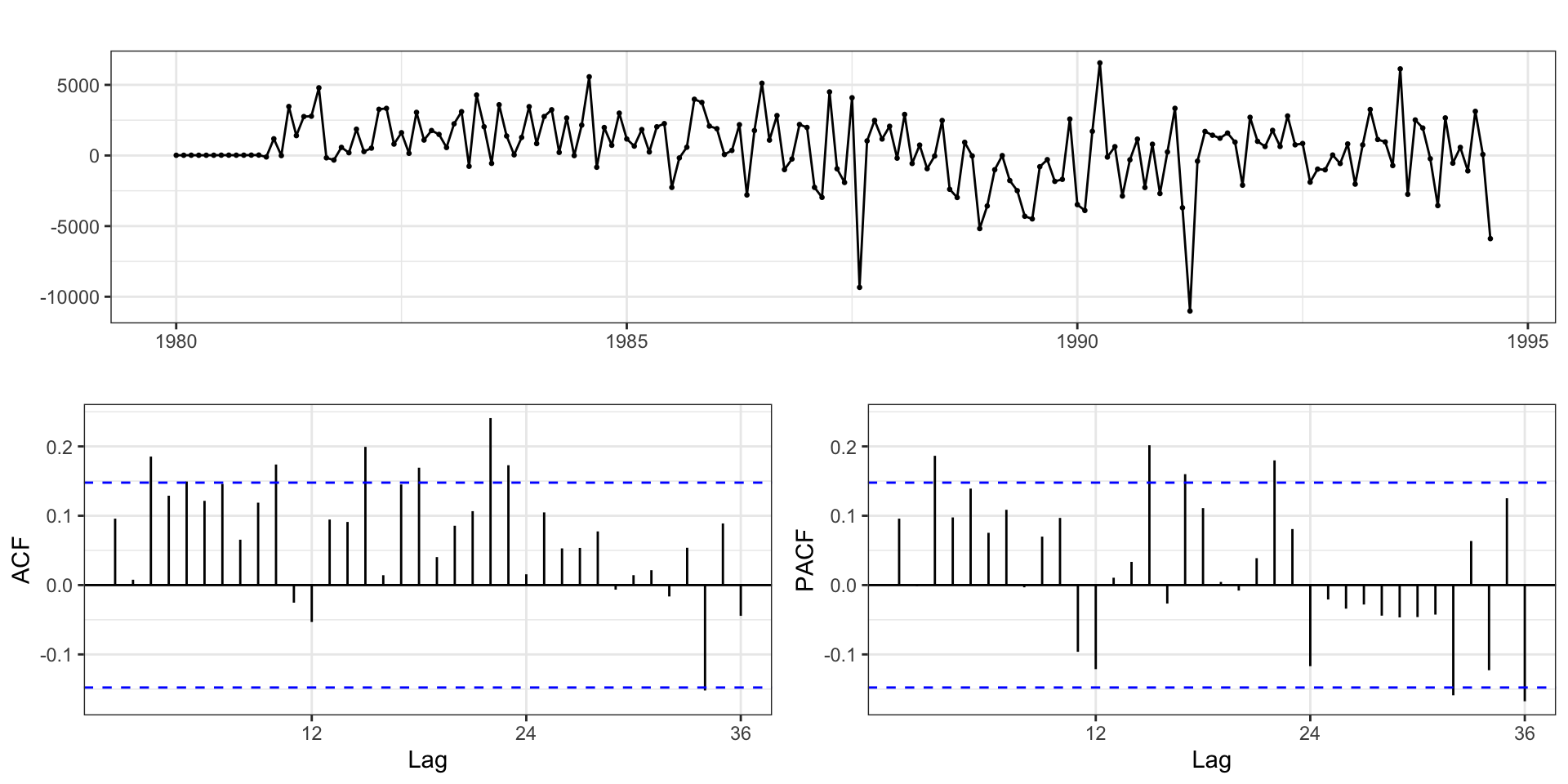

Residuals

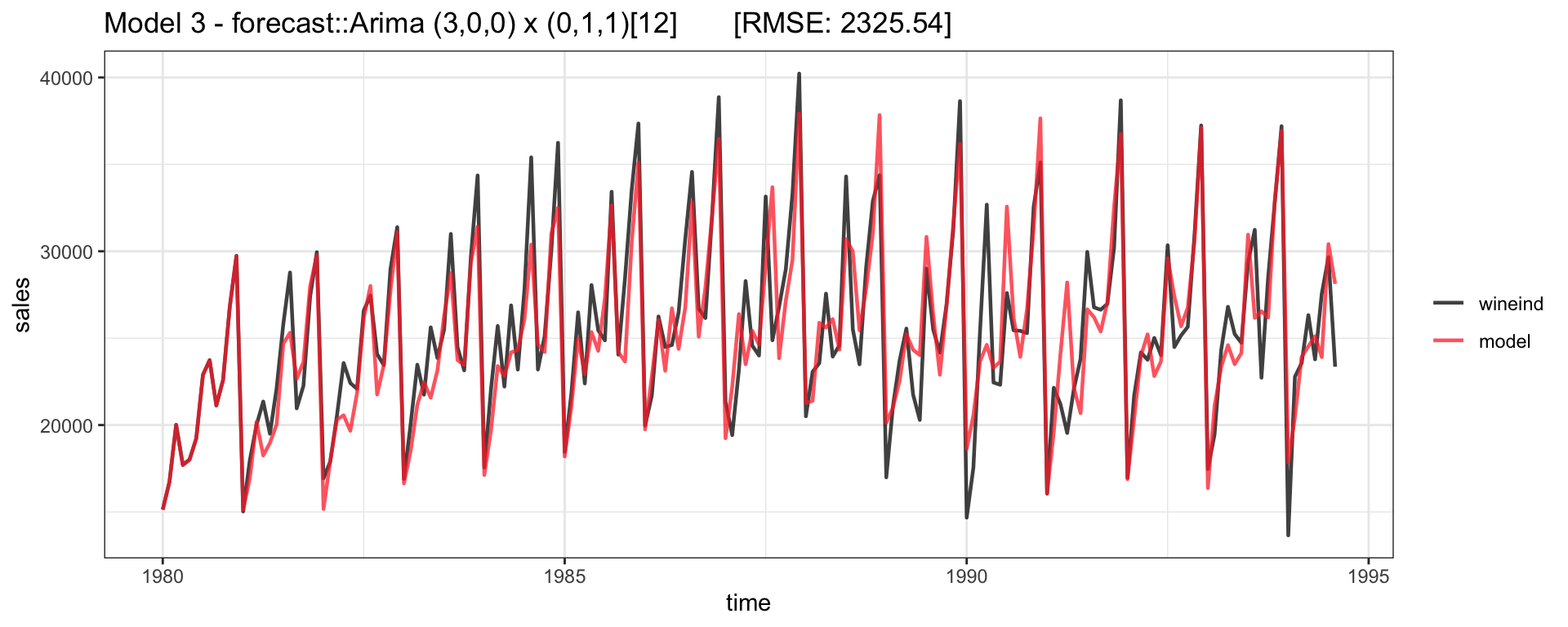

Model 3

\(\text{ARIMA}(3,0,0) \times (0,1,1)_{12}\)

\[ \begin{aligned} (1-\phi_1 L - \phi_2 L^2 - \phi_3 L^3) \, (1-L^{12}) y_t = \delta + (1 + \Theta_1 L)w_t \\ y_t = \delta + \sum_{i=1}^3 \phi_i y_{t-i} + y_{t-12} - \sum_{i=1}^3 \phi_i y_{t-12-i} + w_t + w_{t-12} \end{aligned} \]

Series: wineind

ARIMA(3,0,0)(0,1,1)[12]

Coefficients:

ar1 ar2 ar3 sma1

0.1402 0.0806 0.3040 -0.5790

s.e. 0.0755 0.0813 0.0823 0.1023

sigma^2 = 5948935: log likelihood = -1512.38

AIC=3034.77 AICc=3035.15 BIC=3050.27Fitted model

Model - Residuals

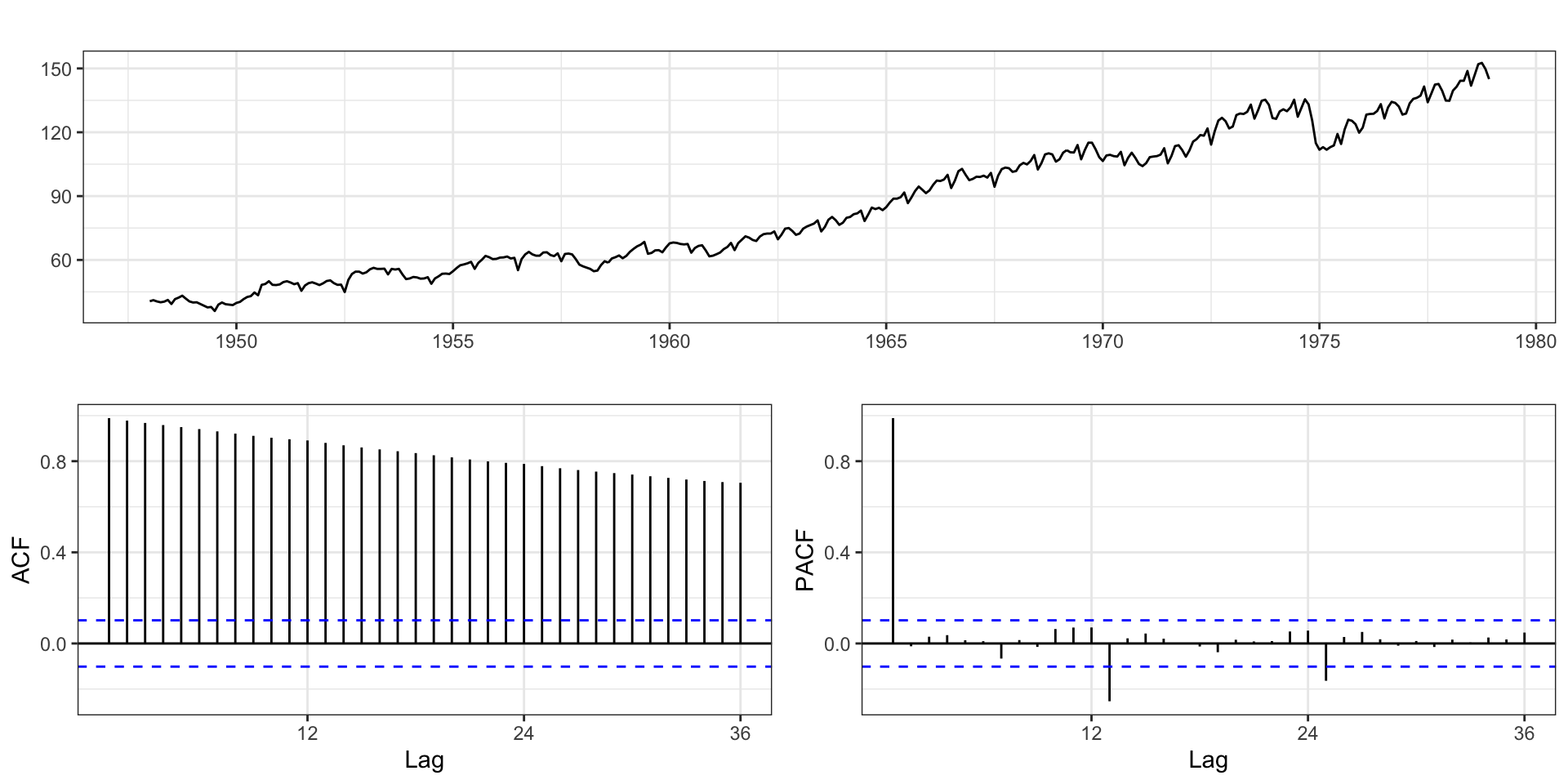

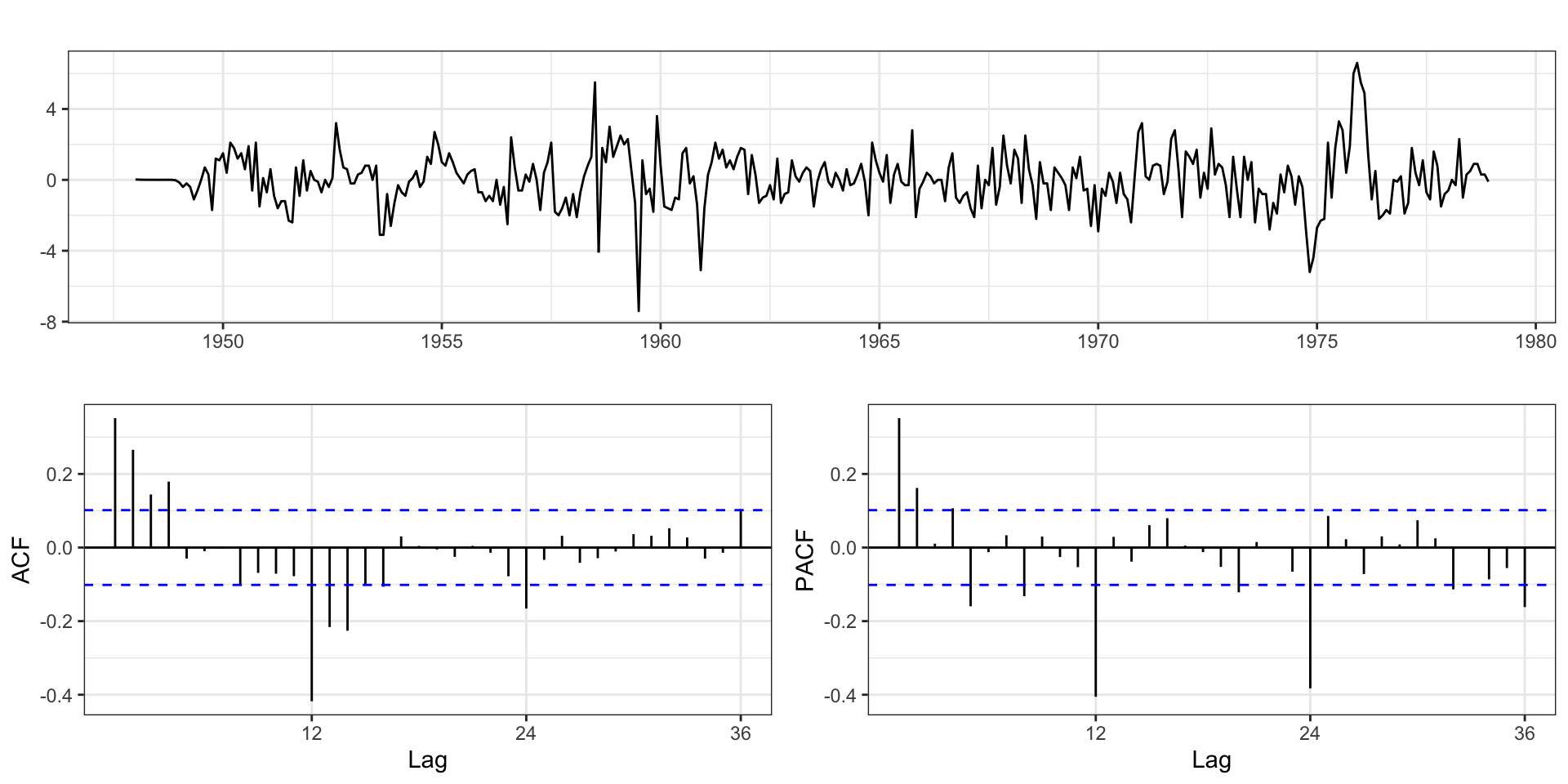

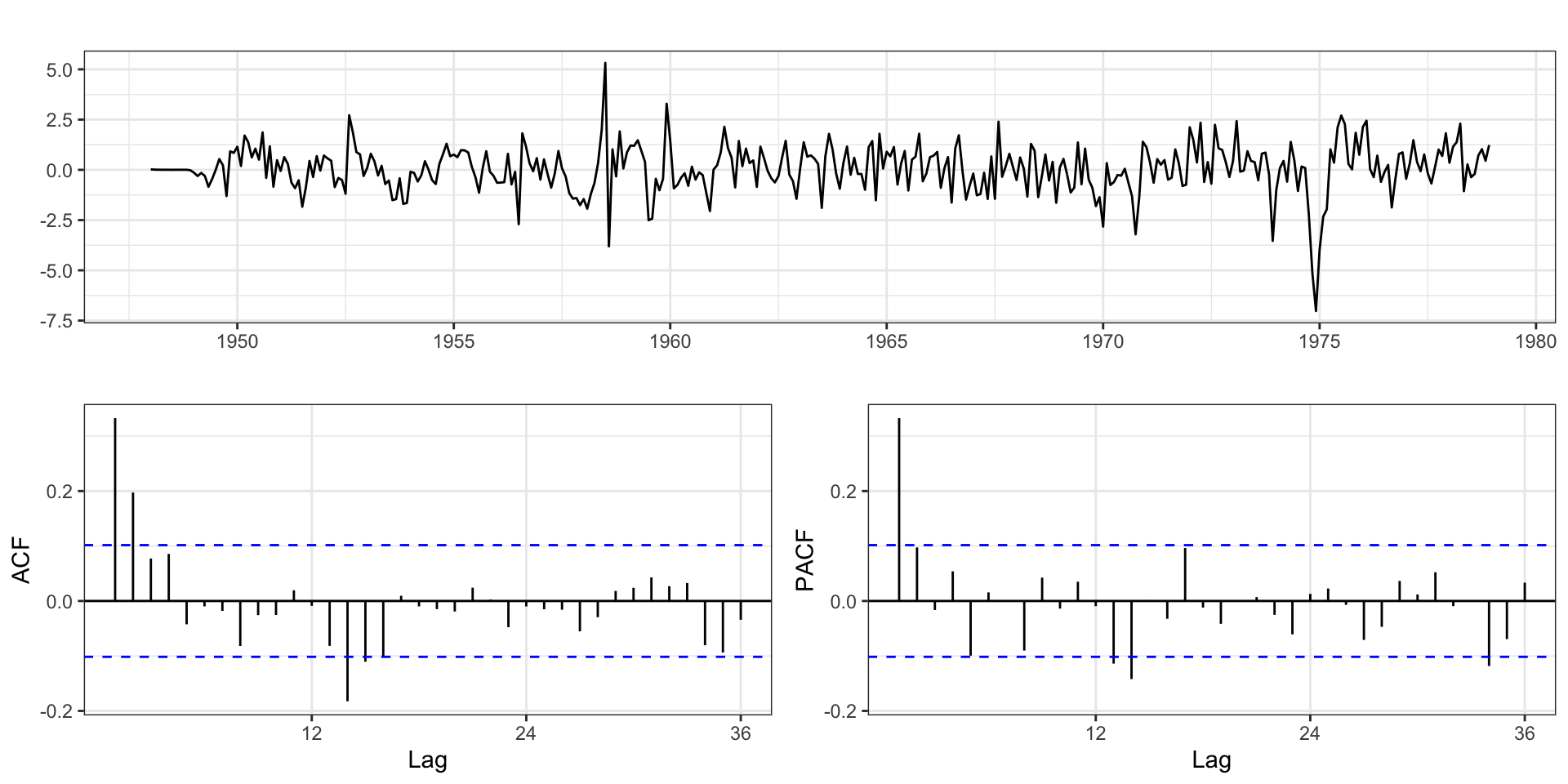

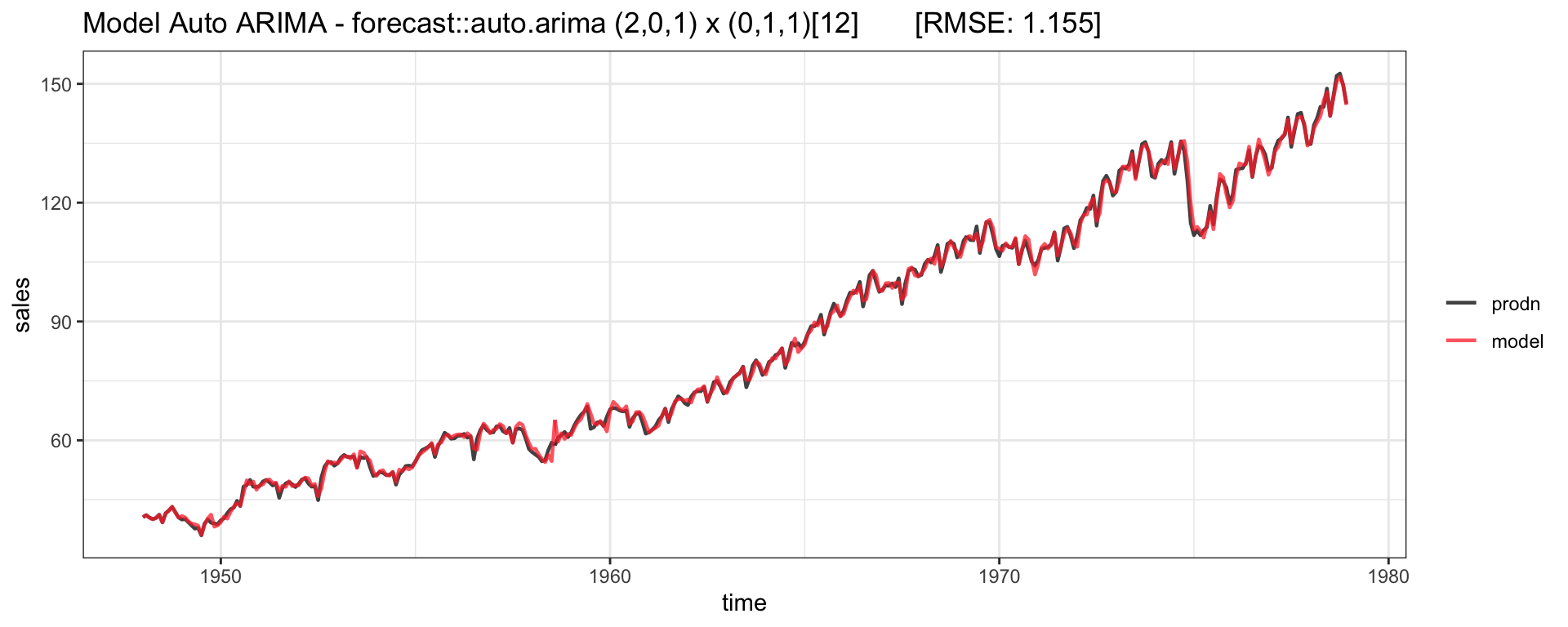

Federal Reserve Board Production Index

prodn from the astsa package

Monthly Federal Reserve Board Production Index (1948-1978)

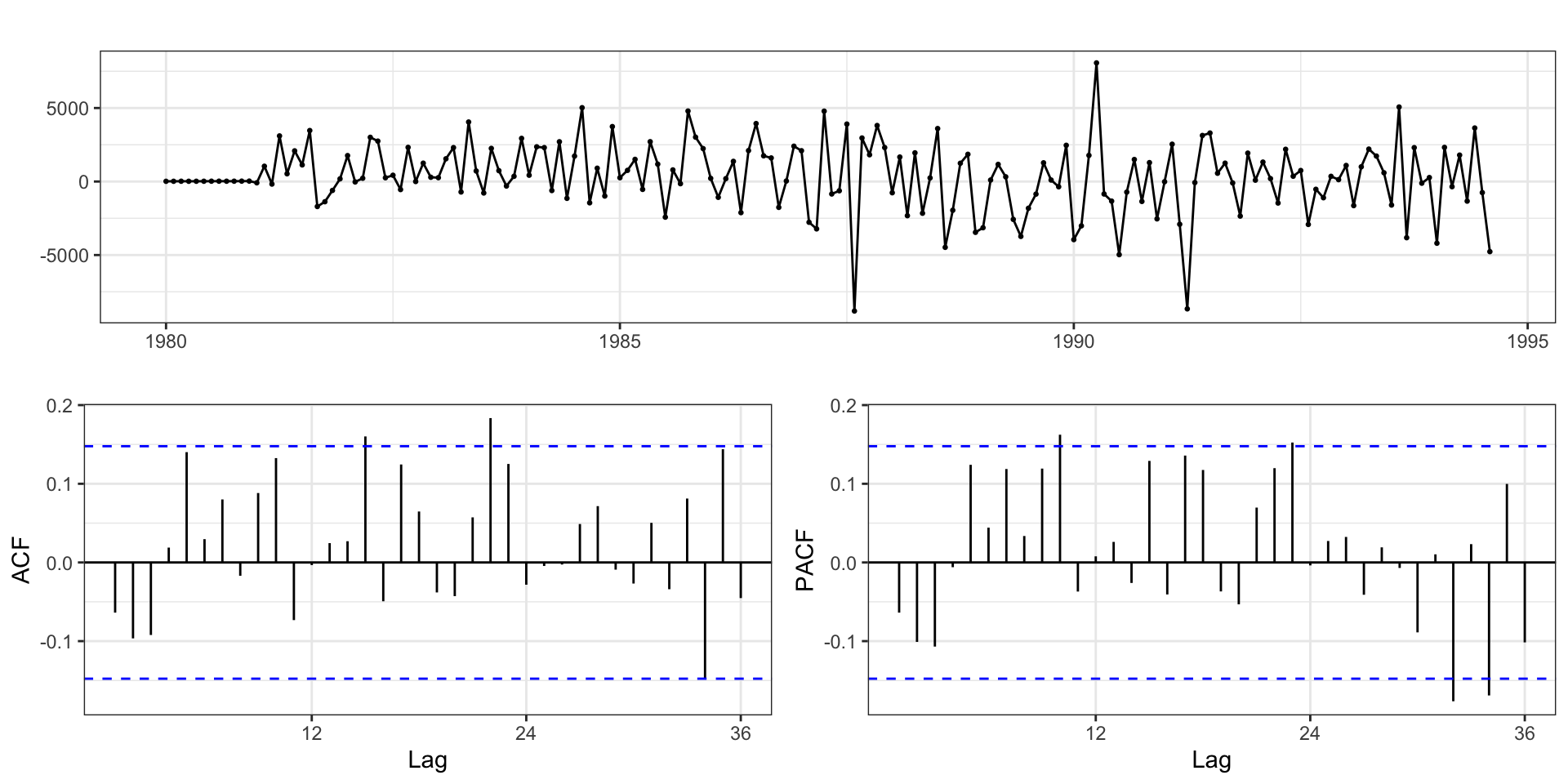

Differencing

Based on the ACF it seems like standard differencing may be required

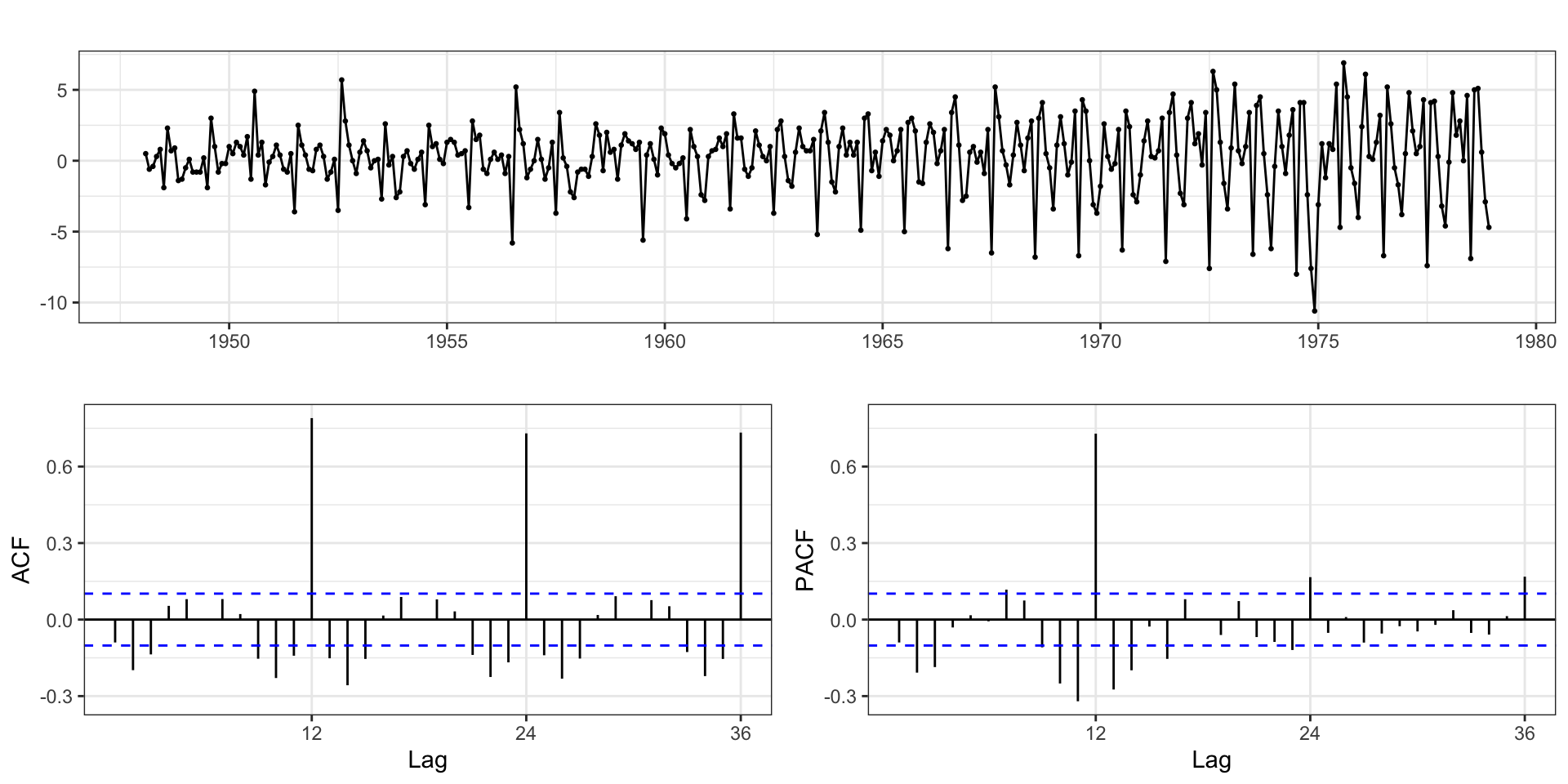

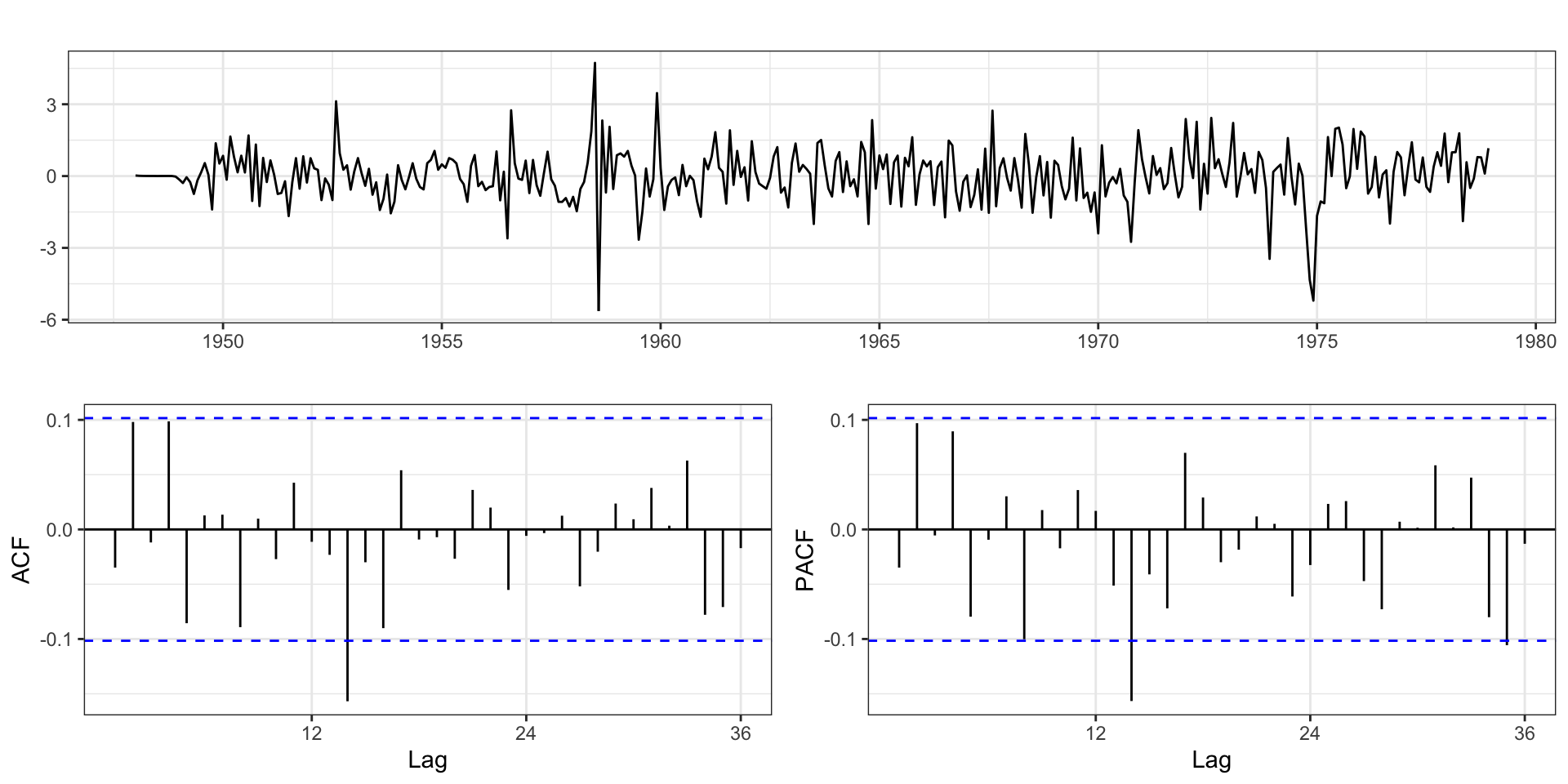

Differencing + Seasonal Differencing

Additional seasonal differencing also seems warranted

Residuals - Model 2

Adding Seasonal MA

Adding Seasonal MA (cont.)

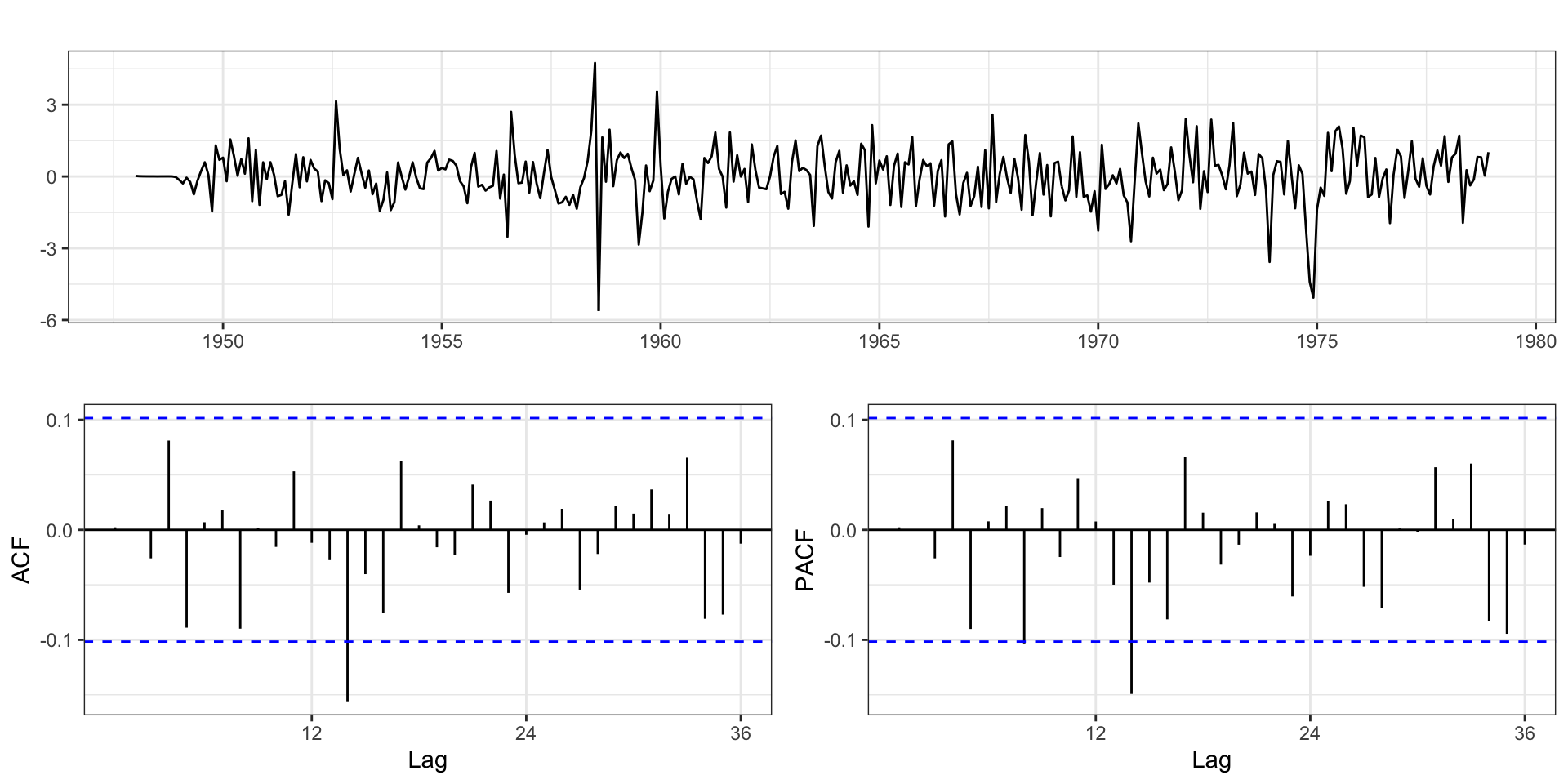

Residuals - Model 3.3

Adding AR

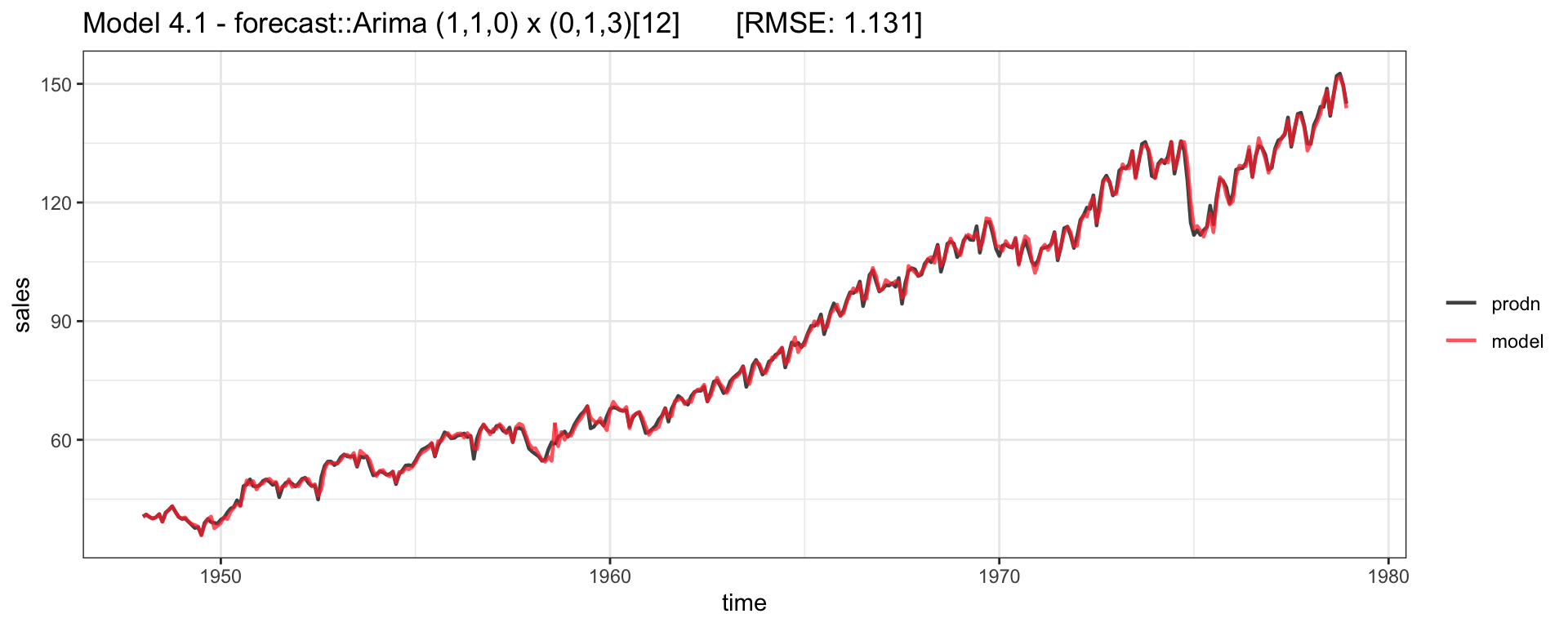

Series: prodn

ARIMA(1,1,0)(0,1,3)[12]

Coefficients:

ar1 sma1 sma2 sma3

0.3393 -0.7619 -0.1222 0.2756

s.e. 0.0500 0.0527 0.0646 0.0525

sigma^2 = 1.341: log likelihood = -565.98

AIC=1141.95 AICc=1142.12 BIC=1161.37Series: prodn

ARIMA(2,1,0)(0,1,3)[12]

Coefficients:

ar1 ar2 sma1 sma2 sma3

0.3038 0.1077 -0.7393 -0.1445 0.2815

s.e. 0.0526 0.0538 0.0539 0.0653 0.0526

sigma^2 = 1.331: log likelihood = -563.98

AIC=1139.97 AICc=1140.2 BIC=1163.26Residuals - Model 4.1

Residuals - Model 4.2

Model Fit

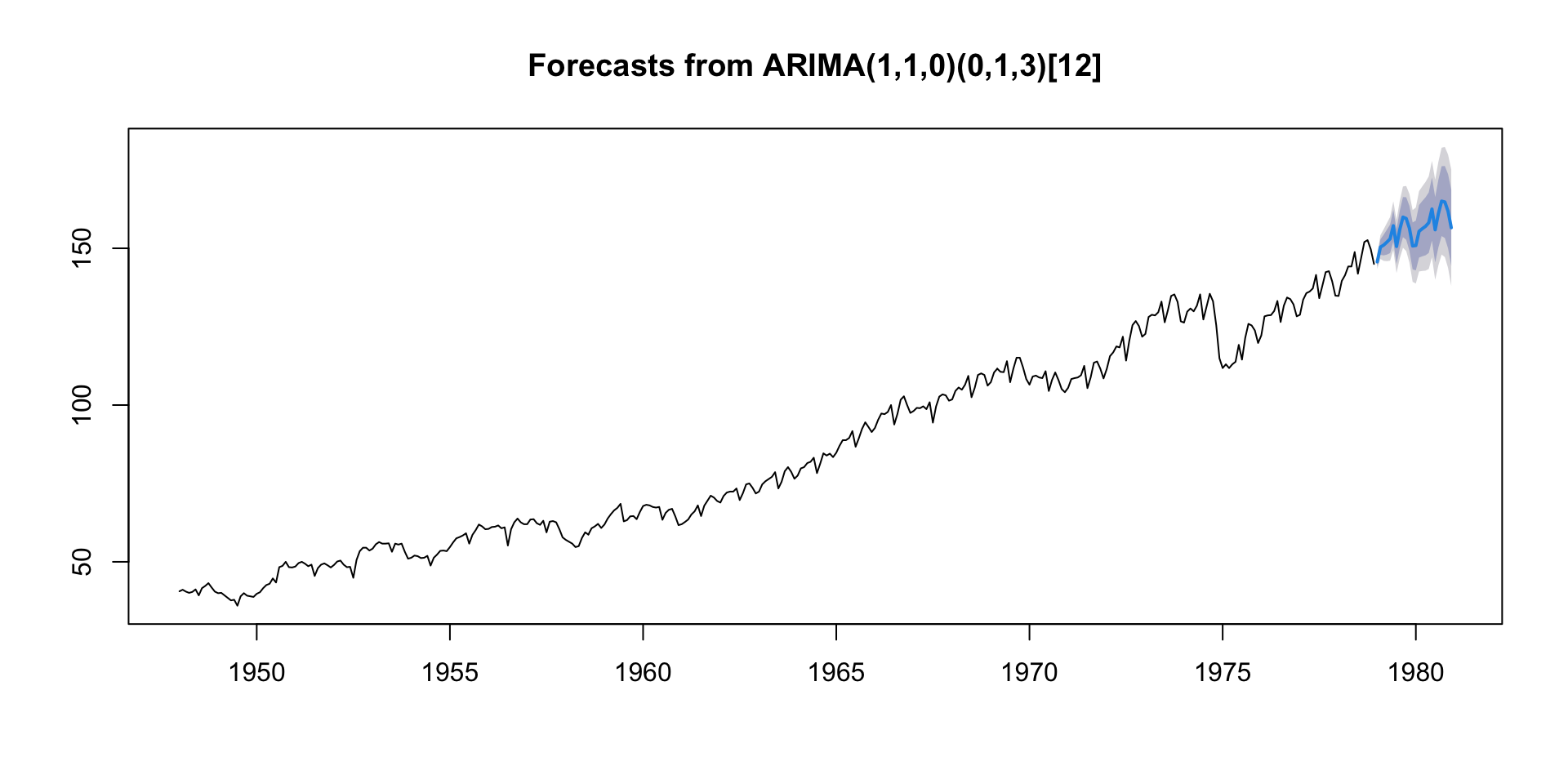

Model Forecast

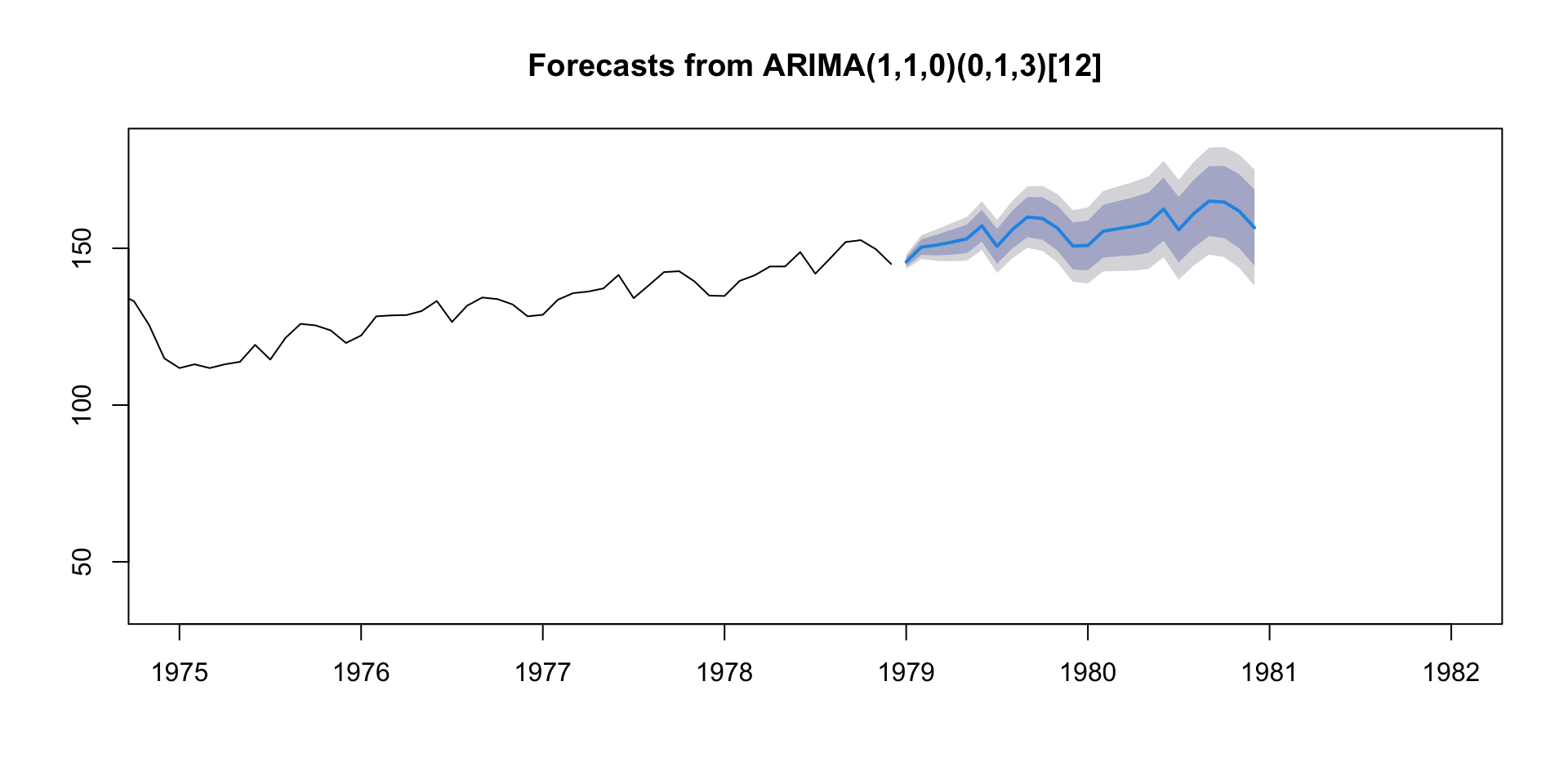

Model Forecast (cont.)

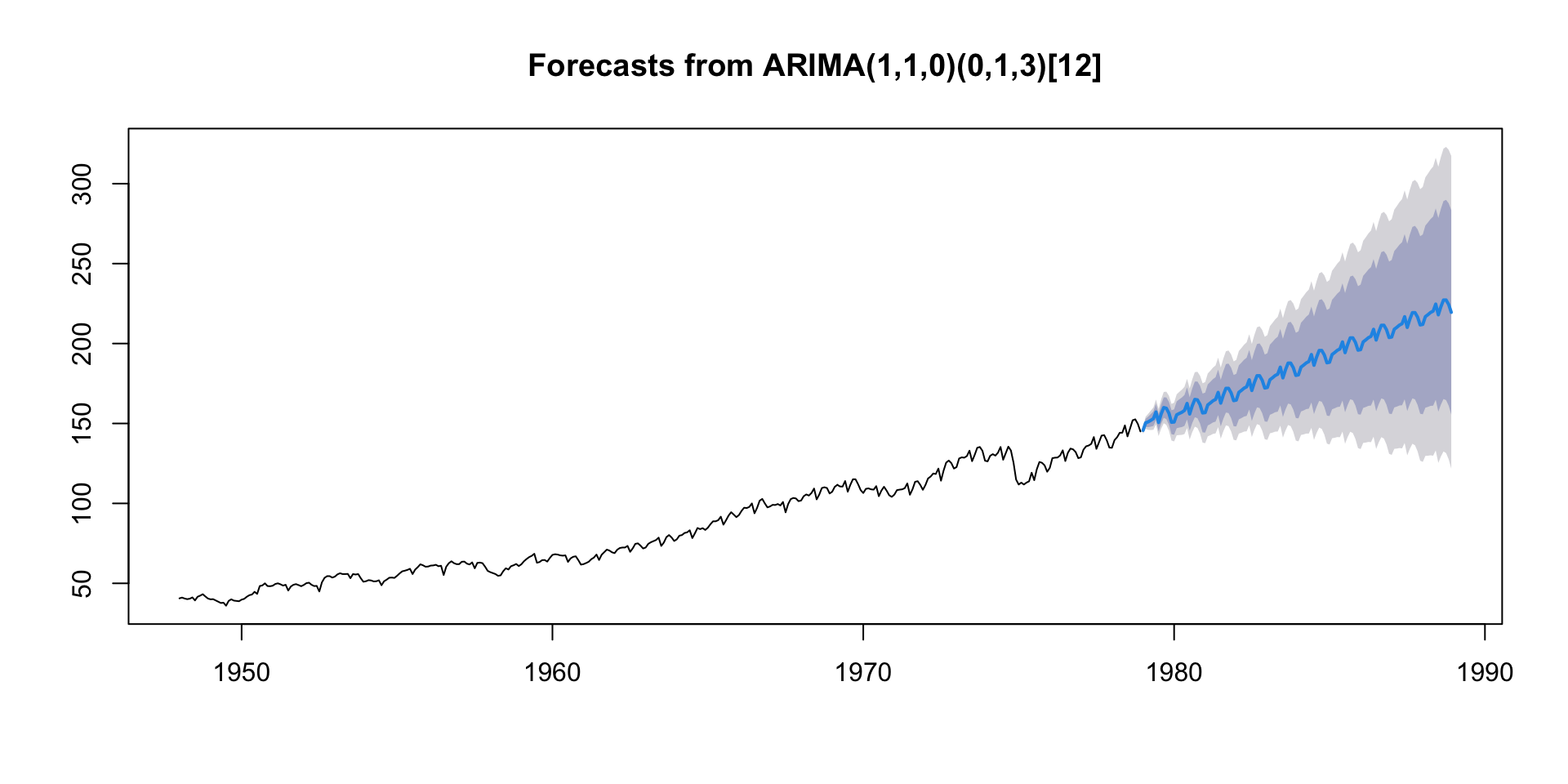

Model Forecast (cont.)

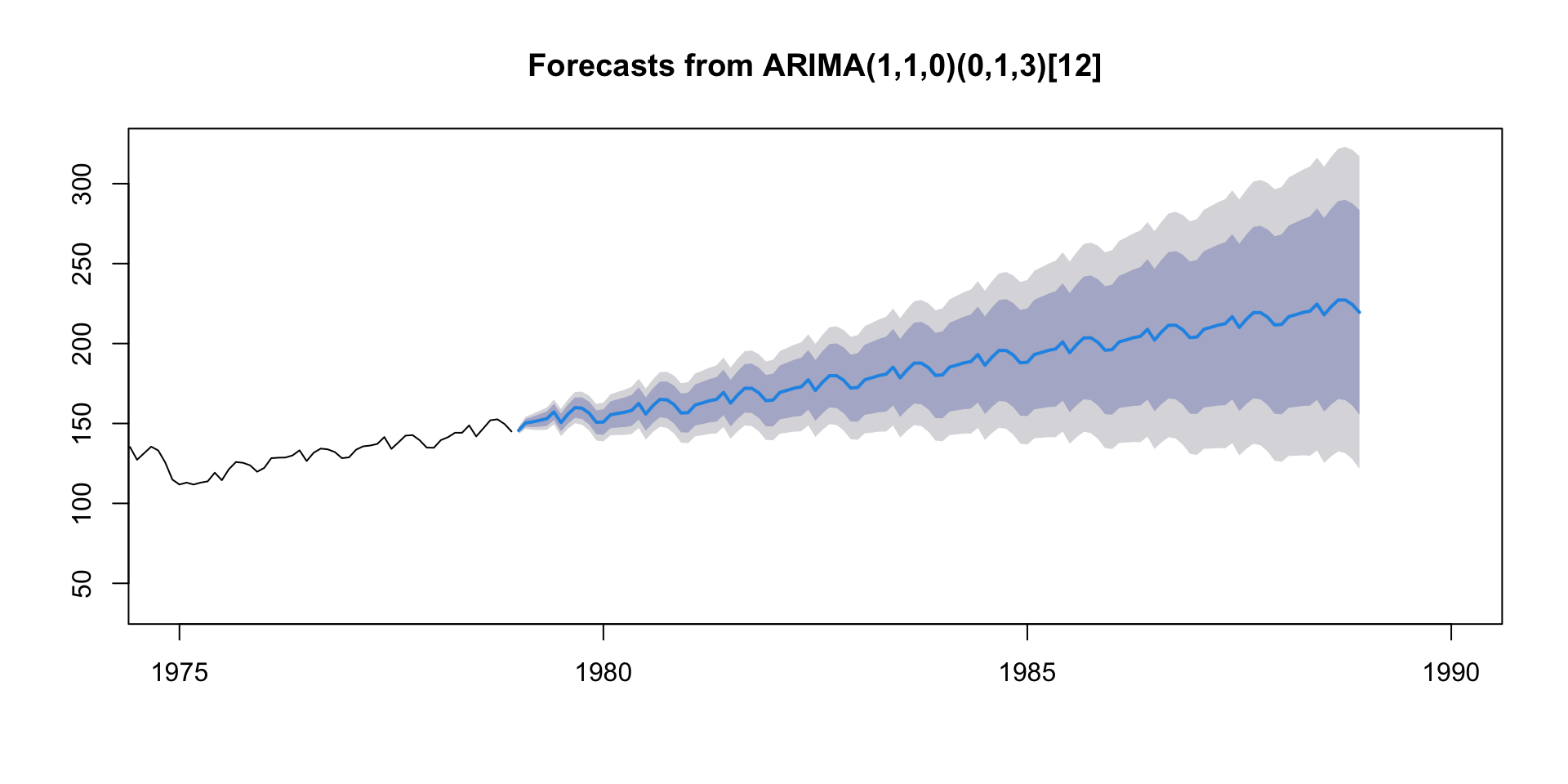

Model Forecast (cont.)

Auto ARIMA - Model Fit

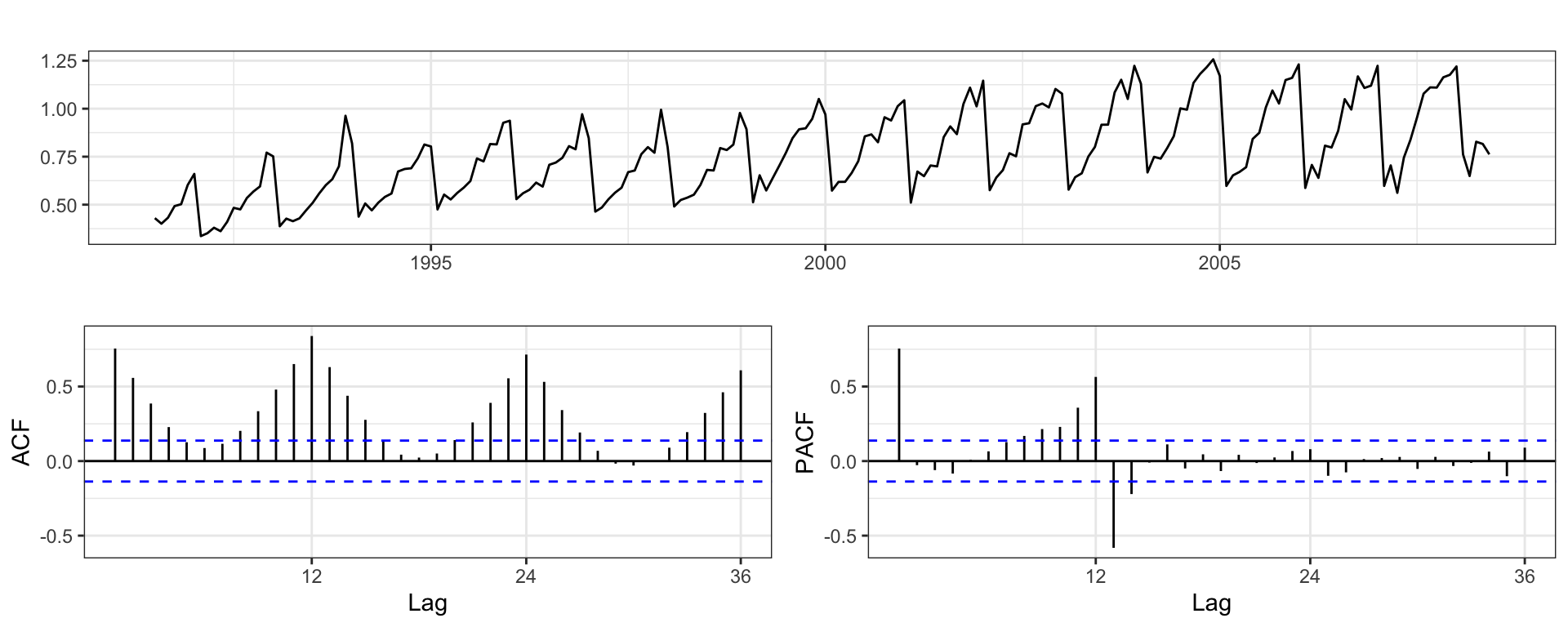

Exercise - Cortecosteroid Drug Sales

Monthly cortecosteroid drug sales in Australia from 1992 to 2008.

Sta 344 - Fall 2022